From Grid & Reshoring Supercycle to Small-Cap Execution: CTOS vs ALTG

Top Down or Bottoms Up? Unemployed Value Degen and Ozeco talk $CTOS and $ALTG

Along with my friend Unemployed Value Degen, we combine bottom-up stock analysis with a top-down macro lens to dissect two small-cap companies positioned to benefit from one of our shared convictions: the grid investment supercycle.

Twice a week, I will release deep dives into stocks and sectors that fit into the three themes that I see winning in this age of tariffs and deglobalization: resilience, sovereignty & reshoring, China. I will then deep dive into the opportunities in the AI data center value chain, healthcare and much more.

Take advantage of this once in a generation opportunity to build long term wealth by investing in great stocks that will deliver returns for your portfolio for years to come.

Table of content

Grid investment supercycle

Custom Truck One Source (CTOS)

Alta Equipment Group (ALTG)

Looking Ahead To The Next Theme

We have always believed that the top down approach and bottoms up approach were complementary, one informs the other and round and round they go. Sometimes we learn about a macro theme by finding a cool company and listening to an earnings call, and sometimes we find a cool company by thinking about a macro theme and diving into a sector. It’s more of a feedback loop than an either or.

One theme that caught both our attention was the aging power grid and its immediate need for updating and expansion. In the US especially, population growth was offset by the offshoring of industry, and for two decades, electricity production was flat. Even before the AI revolution, the environmentalist push to electrify everything was already putting strain on the grid, now with AI, the theme is even stronger.

But as always, the money isn’t made by simply understanding the trend. It’s made by identifying the specific companies that are structurally positioned to capture that massive, sustained demand. We need to distinguish between companies merely exposed to tailwinds and those with business models capable of generating high-margin, resilient profitability from them.

Ozeco has already covered 15 stocks benefiting from this electrification & grid megatrend, focused mostly on large caps like Siemens Energy (a €100bn power and grid equipment superpower, 15% of global power generated with its equipment, a huge beneficiary of the AI buildout, generational load growth and grid cycles, a one stop shop grid equipment provider: gas & wind turbines, large transformers and T&D equipment), Nextera Energy (America’s electricity backbone and one of the most strategically important infrastructure compounders in the US, built on decades of regulated growth and now entering a powerful new phase driven by electrification and AI-driven power demand), Quanta Services (leading utility infrastructure services provider in the midst of an electrical grid modernization and an electrification boom) & cable manufacturers (lead by Prysmian and Nexans, are the real winners at the heart of this tidal wave of investments, turning them from boring commodity plays to some of the most important companies in the world, with under-appreciated margin expansion and valuation upside at the same time as they have derated).

Crack The Market Siemens Energy investment case:

Crack The Market Nextera Energy investment case:

Crack The Market Quanta Services investment case:

Crack The Market Cable manufacturers - The pure players of the Golden Age of Electricity and AI

But Unemployed Value Degen prefers turning over rocks within small cap stocks. Why small caps? The odds of finding real mispricing are a lot greater, but the odds of finding problems are greater too. There are a lot of fish in the sea, but there’s a lot of trash in the sea also.

Our research led us to identify two industrial beneficiaries from the grid megatrend: Custom Truck One Source (CTOS) and Alta Equipment Group (ALTG). These companies operate in the trenches, supplying the specialized equipment and services, from customized bucket trucks to earthmoving machinery, that make this supercycle possible.

While both are exposed to powerful tailwinds, they have very different financial structures, particularly around leverage and capital allocation, and they approach cyclical industrial demand in fundamentally different ways. Understanding those differences, the positioning, risks, the balance sheet mechanics, and capital efficiency, is the key to deciding which stock could fit within your portfolio.

Grid investment supercycle

Crack The Market Electricity is the new oil - load growth and grid investment supercycle:

Crack The Market Electricity is the new oil - podcast:

Time to invest in the grid - the rise of T&D capex:

The reason these niche equipment providers matter is the convergence of structural decay and disruptive demand.

North America is running a modern economy on an electrical grid that, in many regions, was built nearly 70 years ago. This isn’t discretionary spending, it’s unavoidable replacement and maintenance simply to preserve system stability. This guarantees sustained investment regardless of political or technological shifts.

Beyond replacement, electrification and AI are driving capacity expansion. The transition from coal to natural gas and renewables requires entirely new transmission corridors. AI is the true wildcard with data center electricity demand booming.

Supporting this growth requires new substations, transformers, cooling systems, and heavy lifting equipment. This unanticipated demand accelerates the entire infrastructure cycle and compresses timelines, benefiting both CTOS and ALTG.

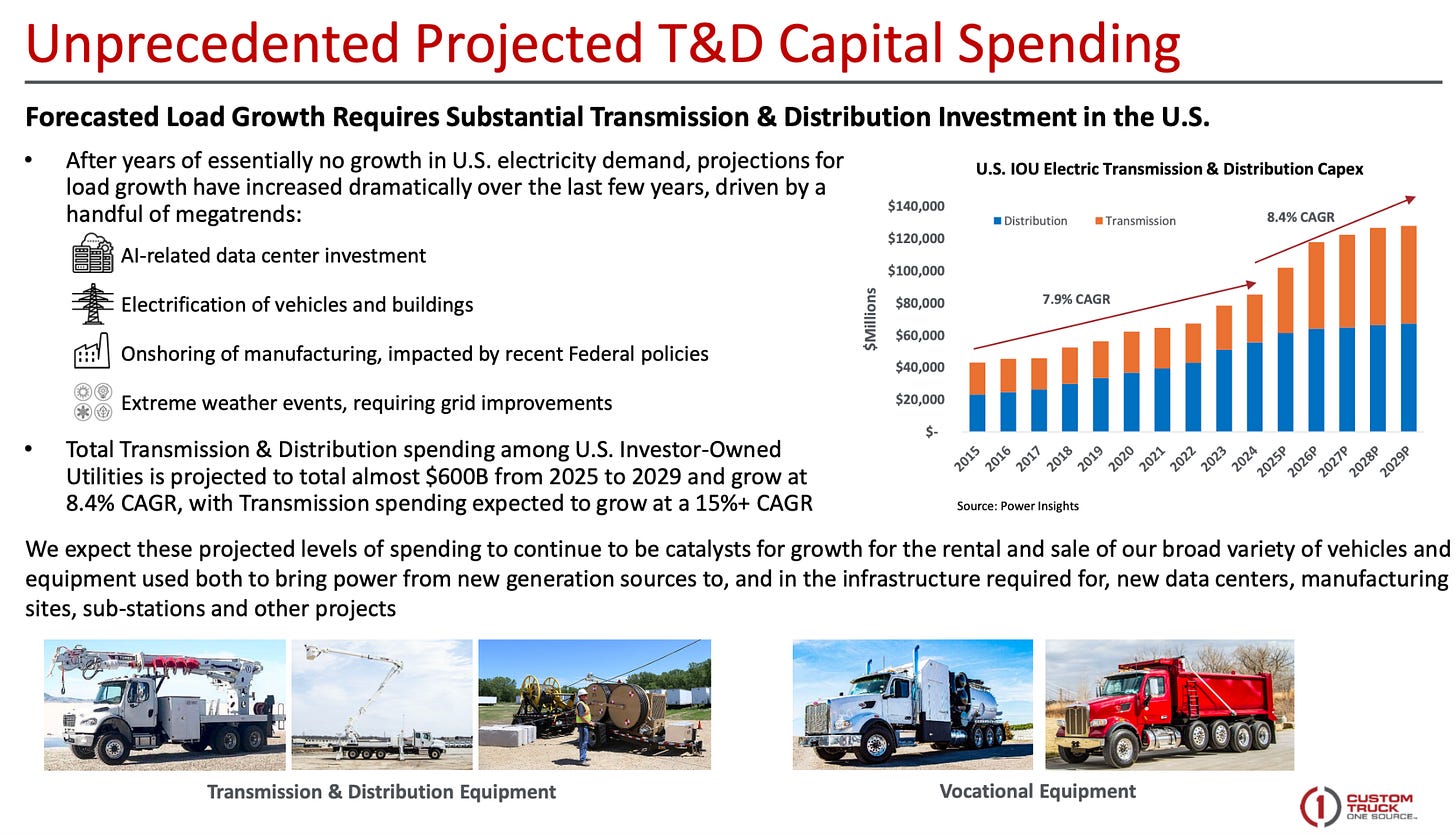

Historically, US transmission spending grew steadily at around an 8% CAGR from 2000 to 2019, reaching roughly $40 billion. But the scale today is fundamentally different with a significant acceleration in grid (Transmission & Distribution) capex over the next few years, with a 9% growth for a $91 billion market. Total T&D spending among US Investor-Owned Utilities is projected to total almost $600 billion from 2025 to 2029 and grow at 8.4% CAGR, with Transmission spending expected to grow at a 15%+ CAGR.

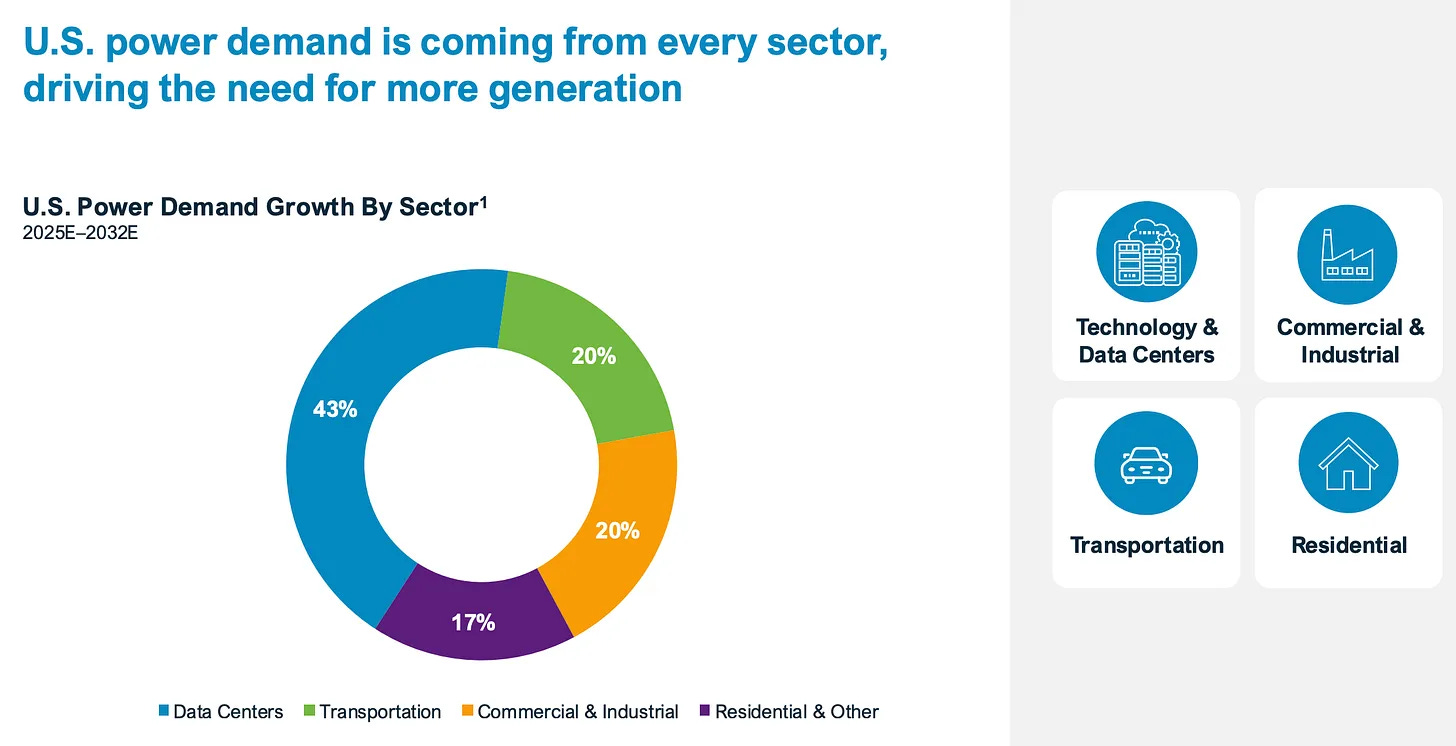

Why is electricity demand suddenly booming? We are seeing a historical inflection in load growth in the West after 2 decades of no electricity demand growth, putting further pressure on utilities to upgrade grid infrastructure:

Load growth returns: After two decades of stagnation, electricity demand in Western economies is finally inflecting. Since 2008, consumption has cumulatively declined by 10%. But the rapid expansion of data centers and the steady electrification of transport, industry, and heating are set to reverse that trend from 0% growth to 3%.

What’s driving the electricity growth of 3% per year? Primarily the steady electrification of heating and industry, electric vehicles (though less so in the US), reshoring and data centers, but this growth driver remains the most uncertain driver out of all of them.

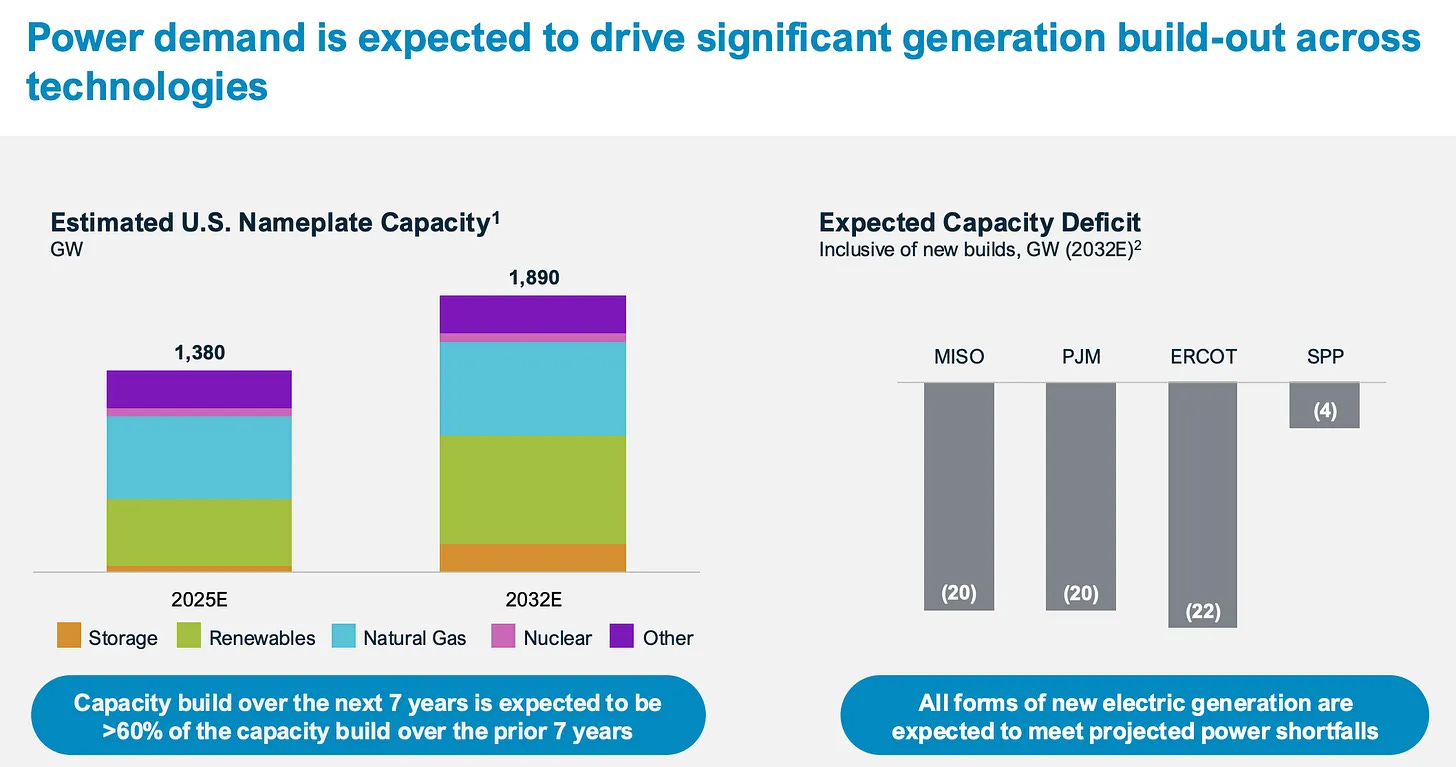

Global electricity demand is projected to grow by around 3% annually by the end of the decade, a sharp increase from the flat growth seen in recent years. To give a sense of how much power is going to be required, in the US, in order to respond to load growth, utilities could need to add 70-90 GW of power generation per year in coming decades, 5-7x more compared to 10-20 GW in the prior 20 years.

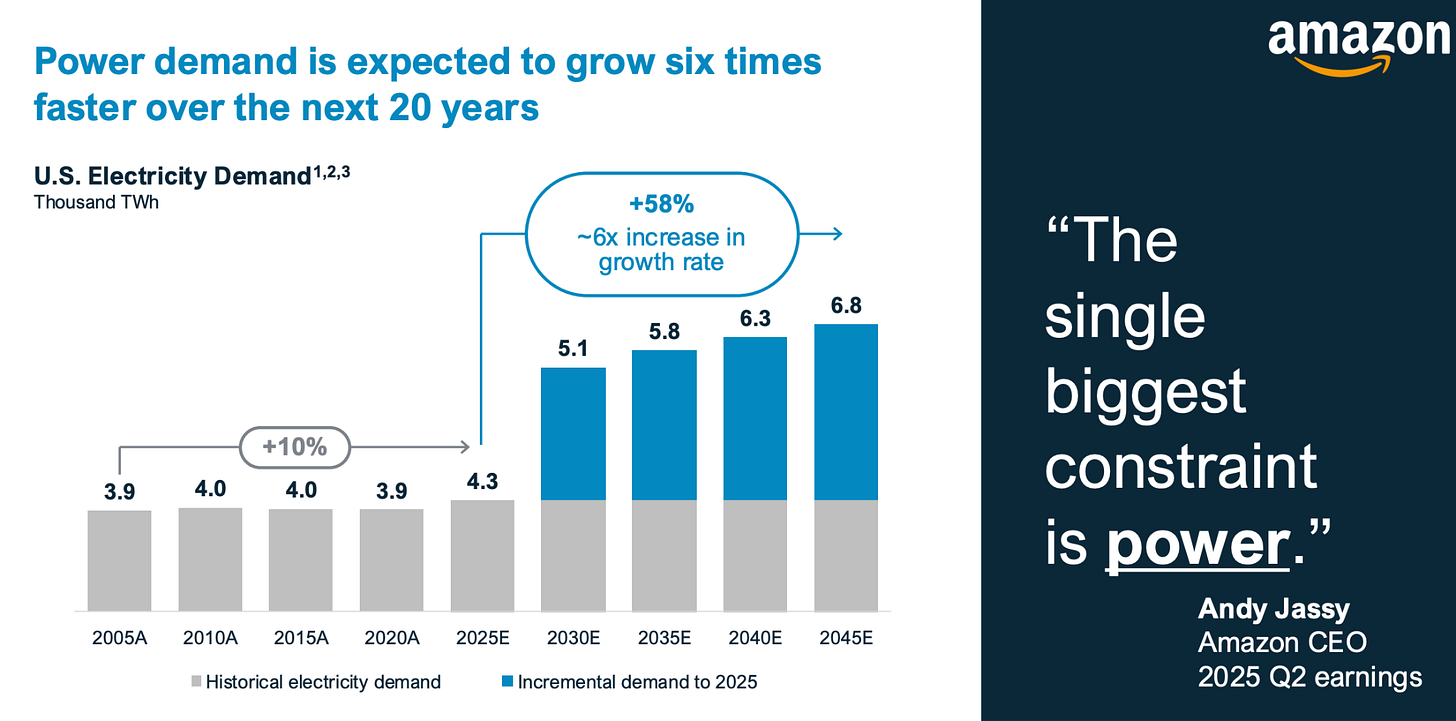

Electricity demand in the US is rising 6x faster than before (from 4,300 TWh in 2025 to 6,800 TWh in 2045): According to the IEA, US annual electricity consumption will increase between 2025 and 2026 (around 4,400 TWh), surpassing the all-time high reached in 2024, going towards 5,600 TWh by 2032. After relatively flat electricity demand between 2005-2020, EIA points to +1.7% 2020-2026 US electricity consumption growth, largely stemming from growth in the commercial sector, which includes data centers, and the industrial sector, which includes manufacturing reshoring. The DOE’s September 2024 Advanced Nuclear report notes that US electricity demand could more than double by 2050 from 4,000 TWh in 2025 to >8,000 TWh in 2050.

Structural growth drivers such as AI data center build-outs, electrification of transport and industry, and reshoring of manufacturing are expected to sustain upward pressure on both wholesale and retail electricity prices. This demand surge could require an additional 500 GW (from 1,380 GW in 2025 to 1,890 GW in 2032) in generation capacity by 2032, which explains why every technology needs to be scaled up. As an example, PJM projects net energy load growth to average 4.8% annually over the next 10-year period, and 2.9% over the next 20 years.

Crack The Market AI Investment Supercycle:

This unprecedented load growth is prompting utilities and policymakers to rethink grid planning, capacity expansion, and reliability strategies to ensure the power system can meet future needs.

Grids are one of the biggest pain points of the energy system, which is why, combined with the historical load growth inflection, we are entering a grid investment supercycle.

Aging grid infrastructure that urgently needs to be replaced, especially in the US and Europe:

One of the greatest barriers to a clean and electrified future is the grid itself. In many developed regions, especially Europe (many transformers and switchgears are 40-50 years old, same for the transmission lines) and the US (>50% of distribution transformers are >30 years old, >30% of HV transformers are >50-60 years old, the transmission lines are outdated with >25% being >60 years old), power grids are decades old. Much of the infrastructure was built in the 1960s and 70s, with a lifespan of 30 years.

Today, the need to modernize is urgent. The grid must not only be repaired, it must be expanded and reimagined to meet future energy needs. Europe and the US are facing the dual challenge of ageing grid infrastructure and rising demand from electrification and renewable energy integration. To meet the demands of electrification, driven by EVs, heat pumps, and data centers, as well as to integrate decentralised renewable energy sources, both regions are generally expected to significantly increase investments into power grids.

Increasing penetration of renewables driving a need to expand grid infrastructure and make it more resilient, requiring critical equipment (like synchronous condensers used to stabilize the grid):

Since 2010, over $10 trillion has been invested in the energy transition with $5 trillion going into renewable energy alone. Installed capacity reached 4,500 GW in 2023, with China and the US leading the way.

But here’s the issue: renewables can’t work without stronger grids. Europe’s grid is 45–55 years old. The US grid isn’t much younger. Meanwhile, over 3,000 GW of renewable energy projects are stuck in grid connection queues, five times the amount of new solar and wind added globally in 2022.

The IEA estimates that for every €1 invested in renewables, at least €1 must go into networks and €1.25 in advanced economies. Yet today, only 22 cents go into the grid for every dollar spent on power generation. The IEA’s Net Zero scenario calls for $800 billion per year in grid investments by 2030, more than 2.5x today’s level. Without that, the clean energy transition stalls.

Custom Truck One Source (CTOS)

Unemployed Value Degen’s CTOS writeup:

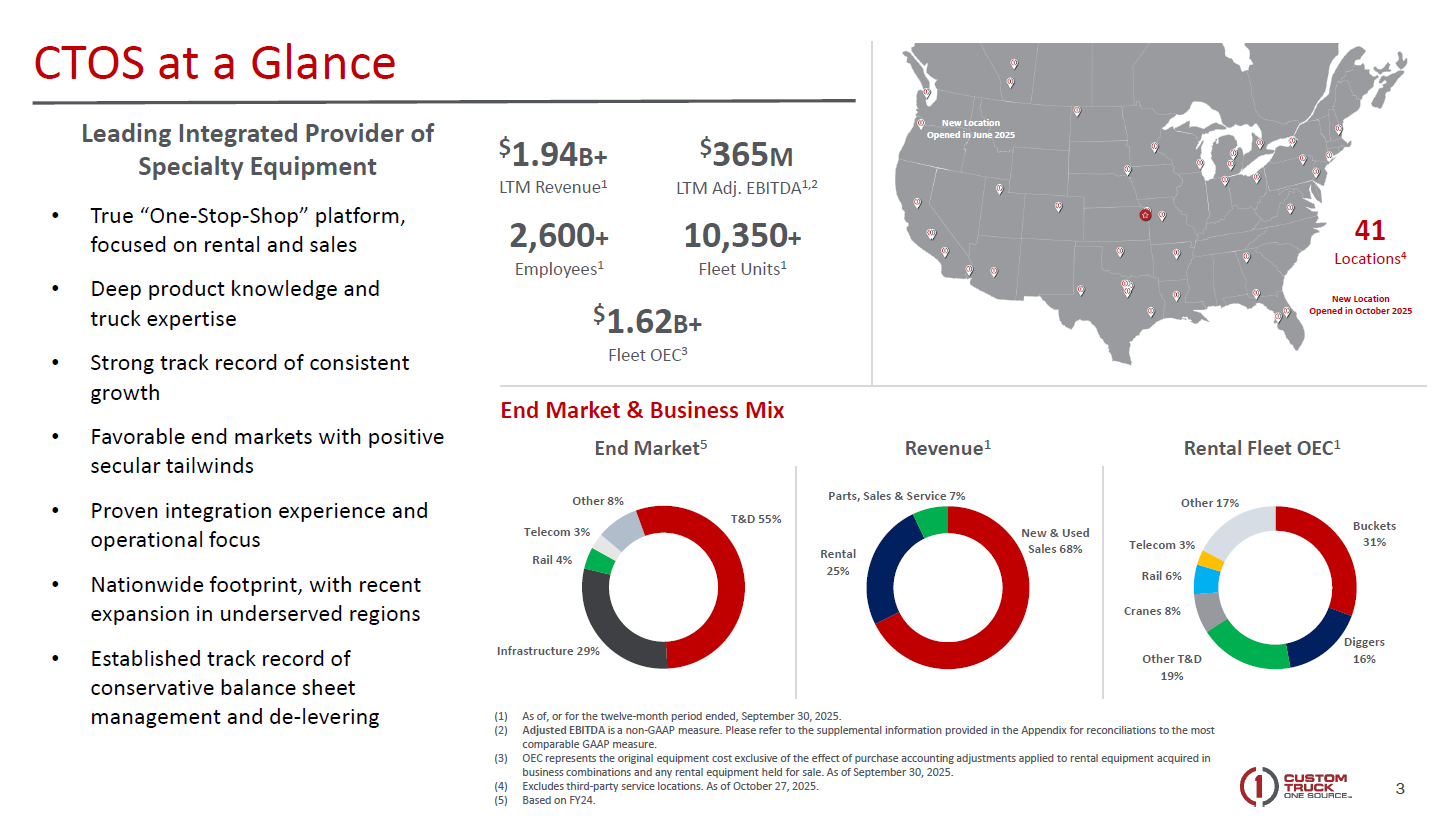

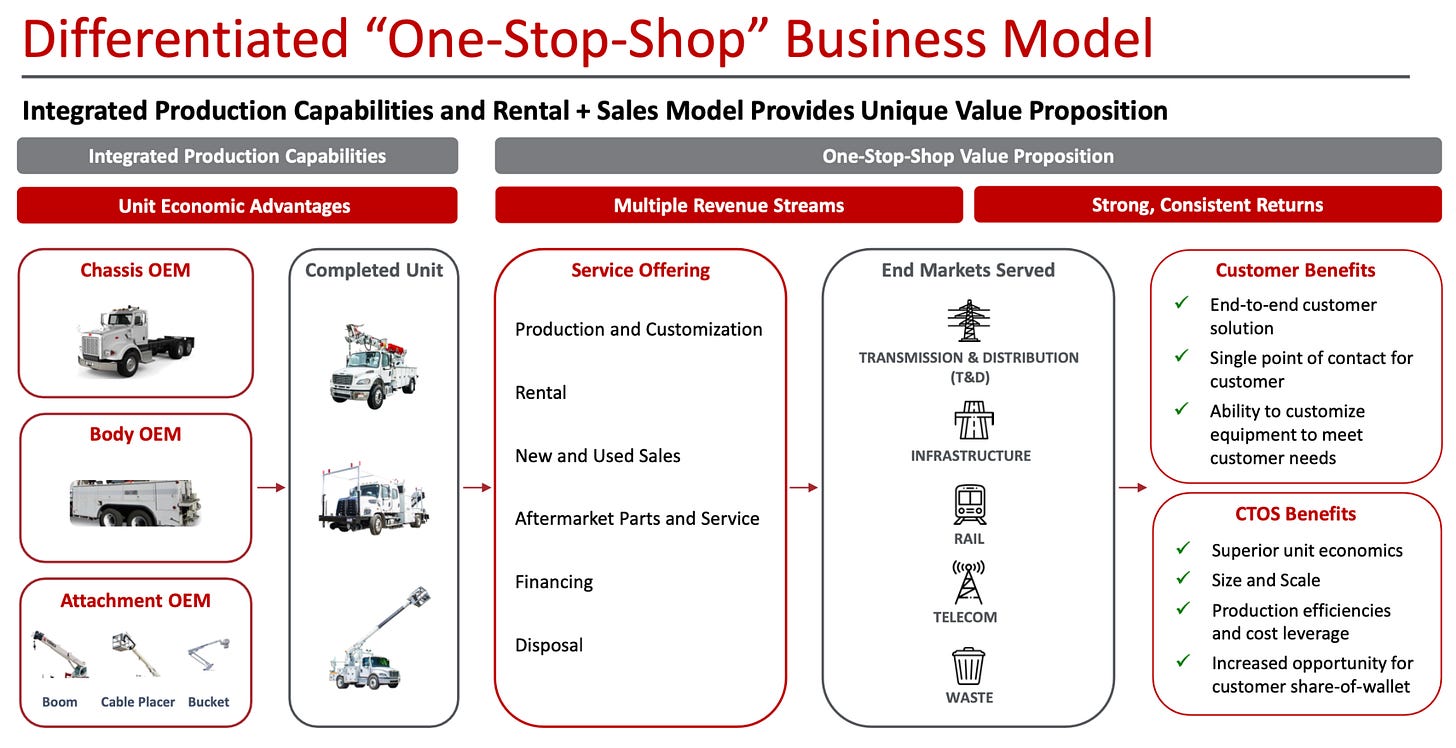

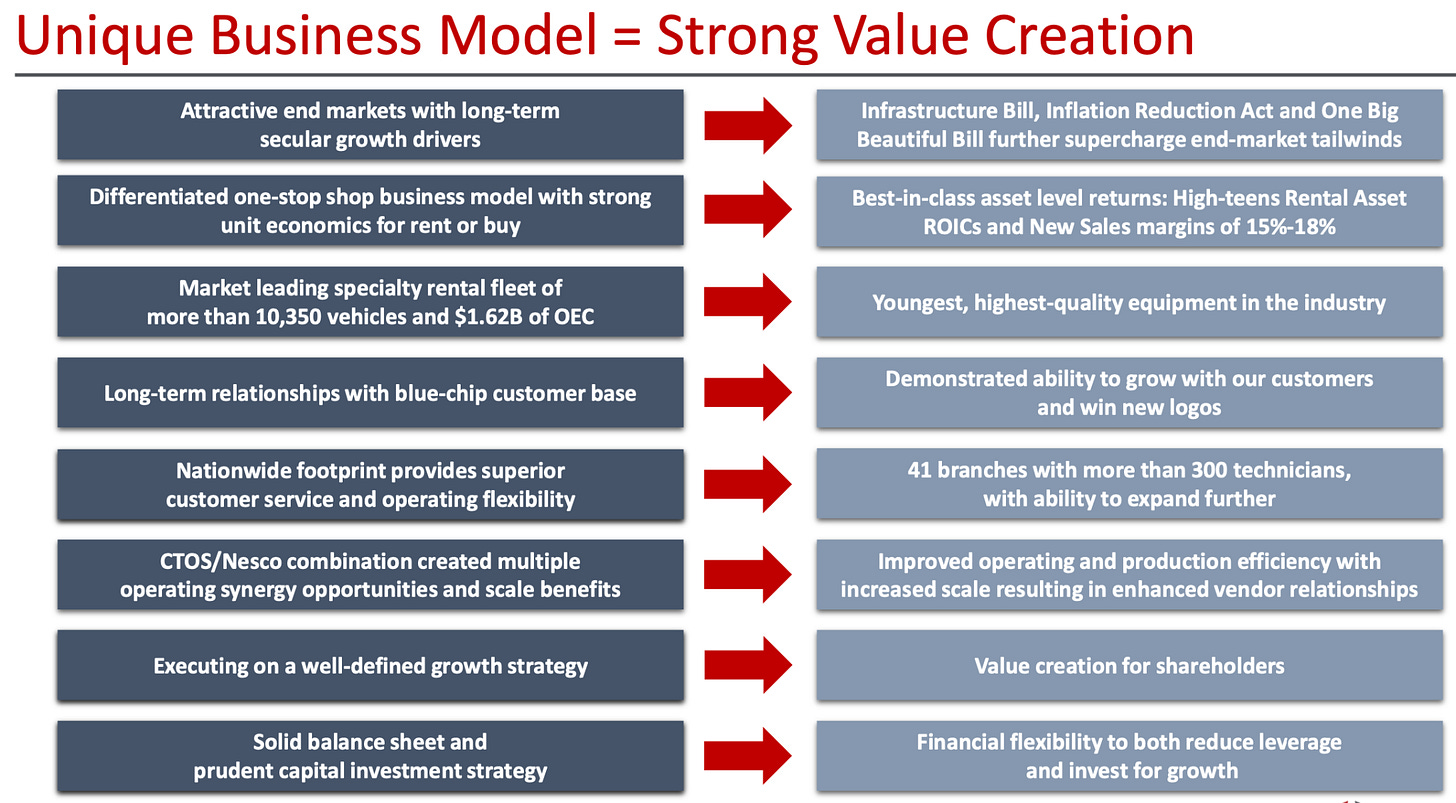

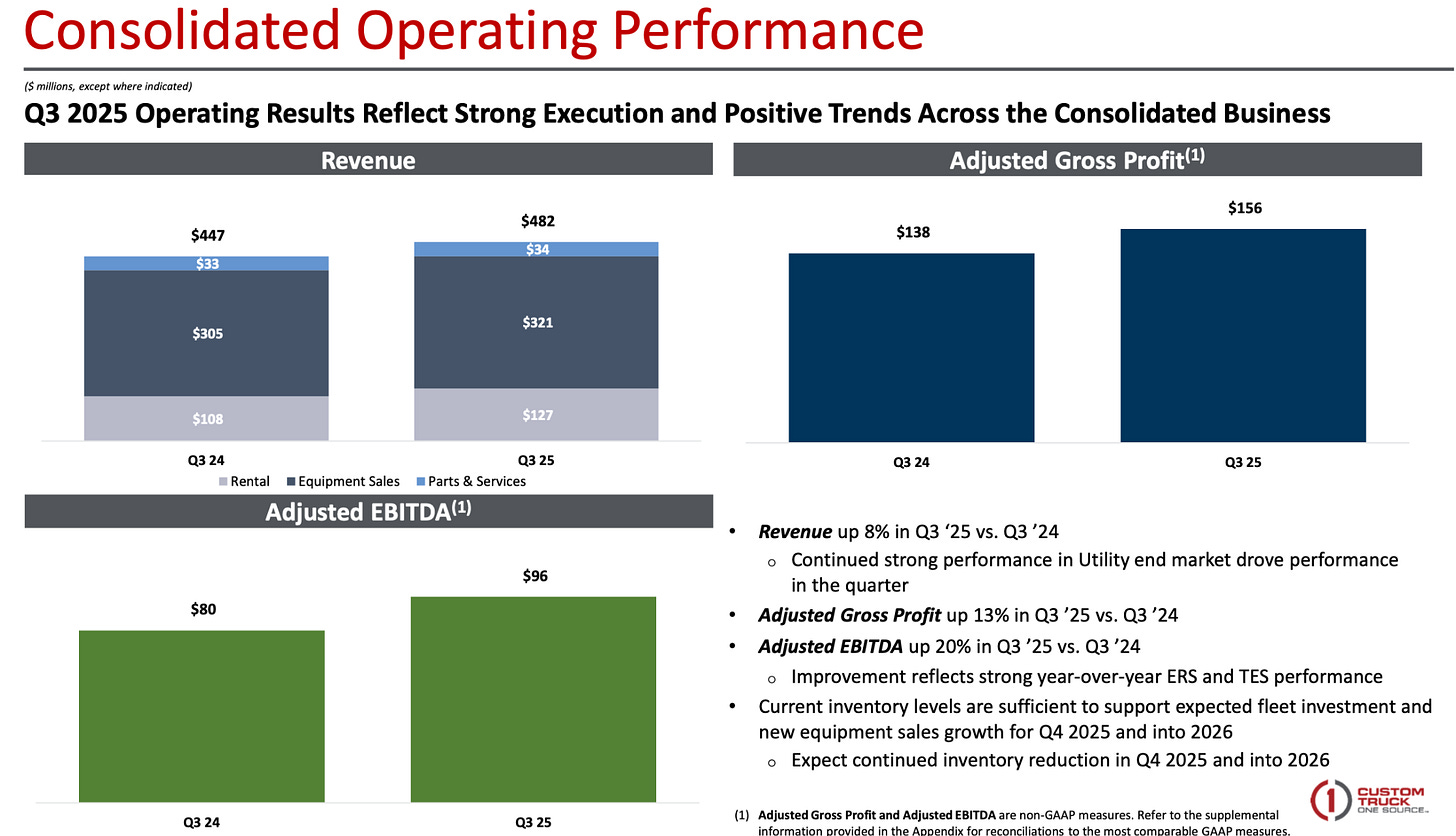

Custom Truck One Source (CTOS) is a $1.3 billion market cap truck dealership and rental business trading at 0.70x price to sales. CTOS is the pure-play on the grid supercycle. Operating over 40 locations across the US and Canada and functioning as a one-stop shop offering rental, sales, parts, service, and critically customization. Approximately 60% of CTOS’s revenue is tied directly to transmission and distribution. If T&D capex remains the strongest and most stable driver, CTOS offers the most direct exposure.

Its rental fleet exceeds 9,600 units, with a relatively modern average age. The equipment, bucket trucks, digger derricks, cranes, vacuum trucks is highly specialized for utility applications. The sorts of vehicles that work on the grid don’t come off the factory line from an original equipment manufacturer (OEM) for sale as is, they are ordered in modules and assembled by companies like CTOS. The company’s competitive moat lies in customization. How customized? Their fleet consists of more than 250 product variations to serve the specialized needs of their customers including various terrain options such as truck mounted, rail mounted, track mounted, and all-wheel drive. CTOS receives chassis and modules from OEMs and performs extensive upfitting and integration to meet regulated utility specifications. This makes CTOS a manufacturing layer within the utility supply chain rather than a simple distributor. They rent, produce, sell, and service a broad range of new and used equipment, including bucket trucks, digger derricks, dump trucks, cranes, service trucks, and heavy-haul trailers. This niche market is so small, exact figures are hard to come by, but we would estimate that CTOS has about 20% market share in assembling custom trucks for working on power lines.

The grid thesis isn’t new, it’s been ongoing for a while already. CTOS revenues are up from $1.167 billion for full year 2021 to $1.94 billion in the trailing twelve months, probably over $1.97 billion for full year 2025 (9% growth). That’s a 13.6% annual revenue growth rate for the last five years, for a company that trades at 0.70x price to sales, and could probably trade as high as 3.0x price to sales at peak when their sector is in favor. If we are conservative and set our target at 1.5x price to sales, this is more than a double from here, and growing revenue every year means you don’t have to wait for cyclicals to be in vogue.

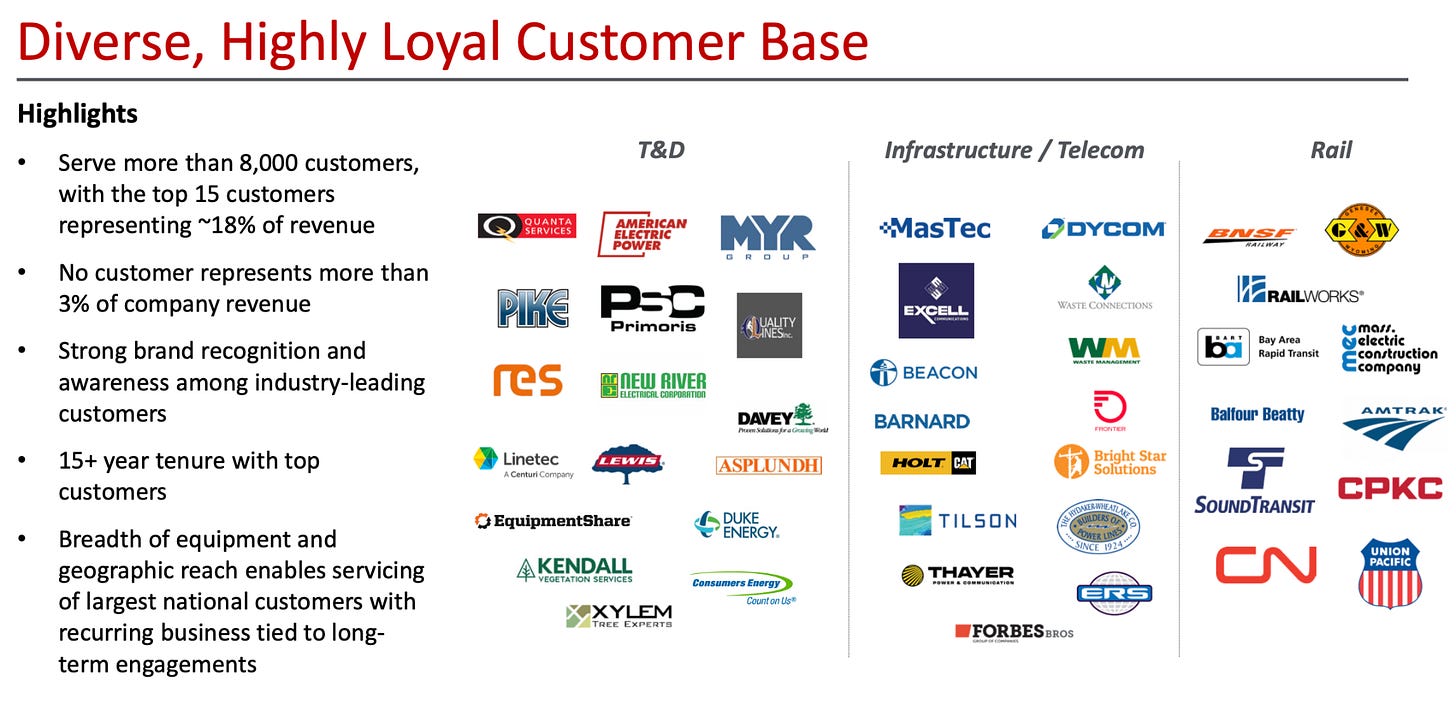

The T&D’s sector toolbox: CTOS has a strong and diversified client base with strong exposure to the T&D capex (with all the major E&C companies in the space represented), telecom/infrastructure and rail customers with >8,000 different customers, the top 15 making 17% of their revenues and no single customer representing more than 3% of total revenues. Of our top 20 customers, 15 of them both rent and purchase equipment. We have very strong brand recognition among our industry-leading customers. They work very closely with their customers, having significant tenure with their top customers, with key relationships spanning more than 18 years.

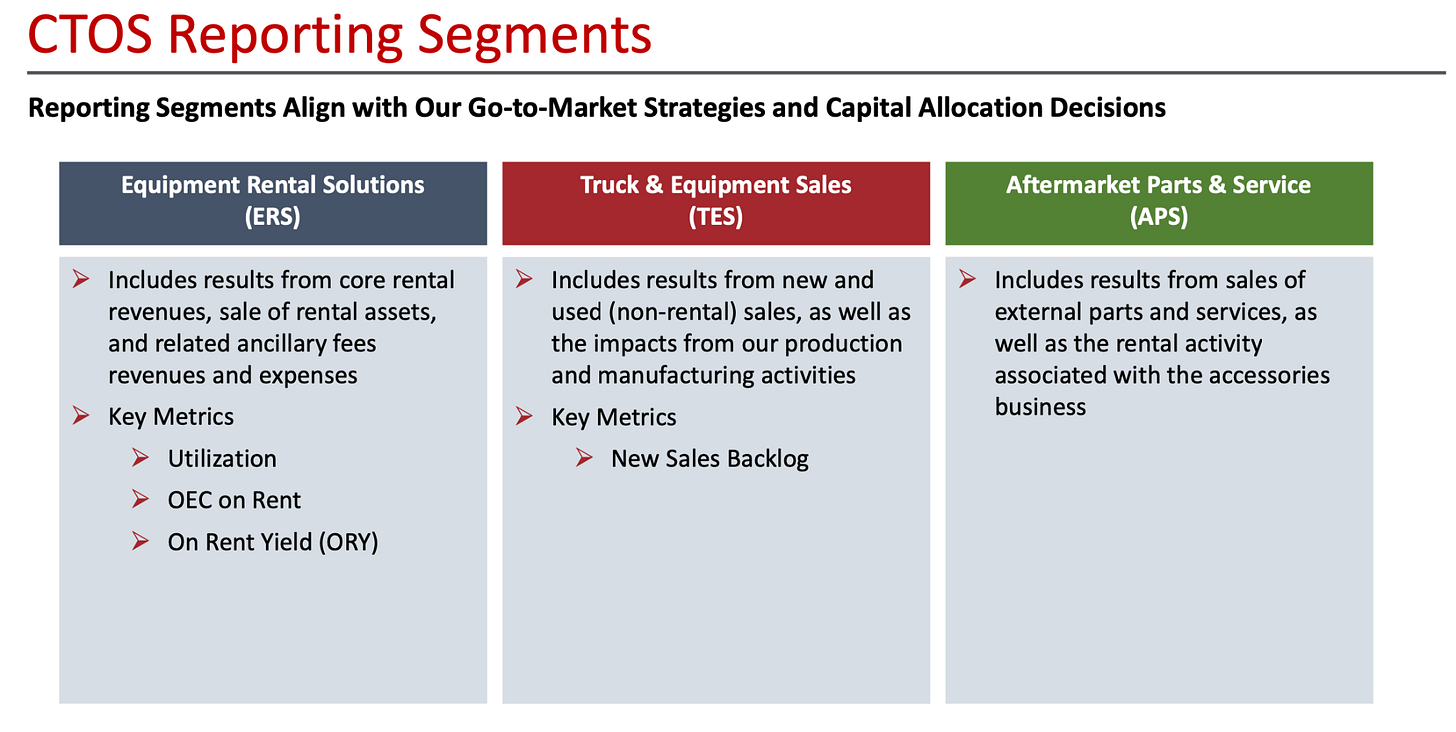

For a small company, it isn’t easy to pick apart because it operates in three modes. In the world of construction equipment, buyers want to do more than take the equipment for a test drive. They often want to rent it for a few months before they buy it, just to make sure it really suits their needs. These heavy equipment dealerships have to maintain a rental business to support the sales team, but to support the capacity, they operate a rental business and drive some extra returns.So CTOS has three segments: new inventory for sale (in TES), rental inventory for sale (in ERS), and rental inventory for rent (in ERS) + the small aftermarket parts and services (APS). This makes digging through the accounting statements a bit tricky as they are constantly transferring equipment from their sales inventory to their rental fleet.

Another tricky aspect of dealership businesses is floor plan financing, that is OEMs forward the inventory to CTOS on loan with a grace period (basically inventory financing with interest-free grace periods). Floor plan financing is usually priced off of the overnight rate, making CTOS a beneficiary of rate cuts even if the 10-year treasury rates stay stubbornly high. But more importantly, floor plan financing comes with a grace period that varies by industry, interest doesn’t accrue for 30, 90, or 180 days depending on the relationship with the OEM. This means that as inventory turnover increases in a boom year, they get an additional benefit of falling interest expense. This gives dealership businesses a lot of sensitivity to interest rates, and a lot of torque from the combined operating leverage and financial leverage.

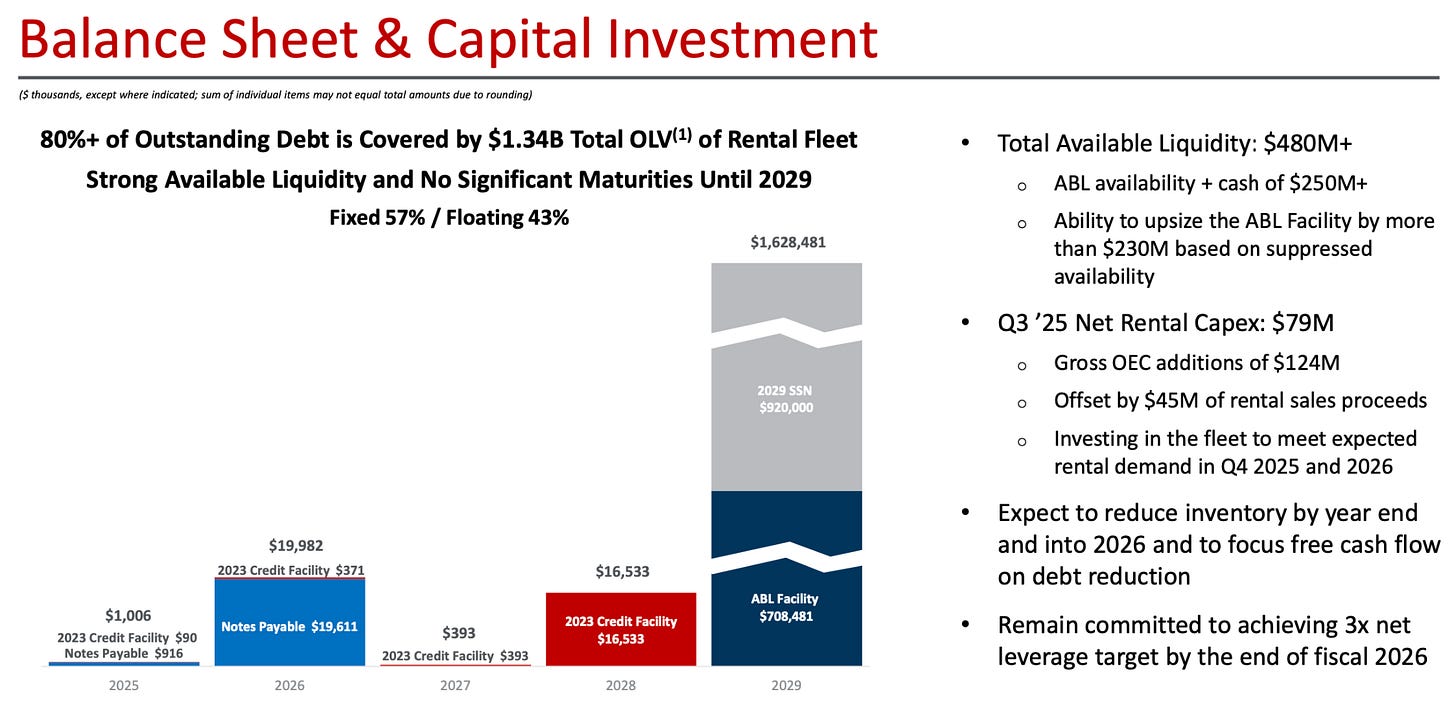

The floor plan financing also makes the company look more indebted than they really are, about $750 million of CTOS liabilities are from this floor plan financing. Beyond that, they have a $920 million Secured Note due in 2029 fixed at 5.5%, and $950 million in an Asset Based Revolving Credit Facility (ABL) at SOFR + 2.25%. Both the ABL and floor plan financing are at variable rates (43% of debt), giving the company a strong exposure to falling interest rates (+/- $1.7m in interest payments for each 1/8th move in interest rates). The leverage is a bit high, but the asset backing gets low interest rates, and the business has been so stable that this degree of leverage hasn’t caused them any trouble.

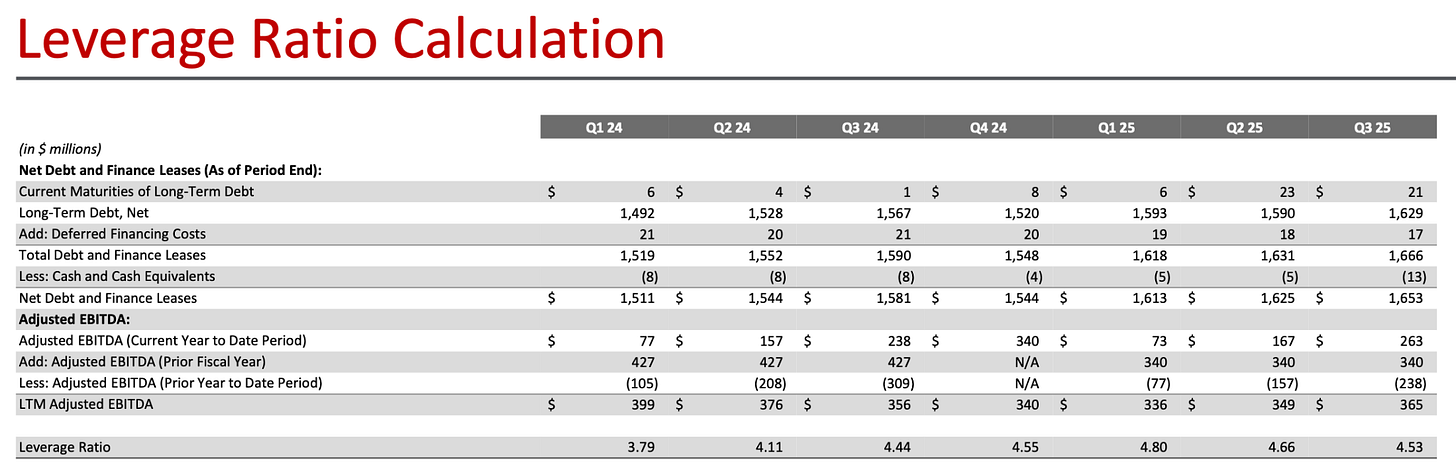

Management isn’t happy with the current share price, and they have three ideas to improve it. The first idea is de-leveraging (management is still committed to achieving 3x net leverage by the end of 2026). CTOS carries elevated leverage, with net leverage around 3.8x adjusted EBITDA, above peer averages. Management targets reducing leverage below 3x through EBITDA growth and debt repayment, but this leaves limited room for error.

The second idea is to try and convince their 70% owner, the private equity firm Platinum Equity, to partially exit. Platinum Equity took CTOS public through a merger in 2021, and they bought in at around $5 a share, so they are looking to exit at a higher price than where it trades today. Such a large seller of shares into the market could keep the stock price suppressed for an extended period of time, although on the other side of that journey, CTOS will be a larger, less-levered company and without the shareholder concerns of private equity controlled corporate governance.

The third idea to improve the stock price is by increasing free cash flow, specifically by expanding the rental equipment fleet into this incredibly strong market as the grid theme is ongoing. Unfortunately growing the rental fleet costs money, and it set back the de-leveraging goal by a bit to grow the inventory. CTOS faces a key capital allocation trade-off: growing its rental fleet versus accelerating deleveraging. Compared to their peers, CTOS is much more focused on the rental income, which should be attractive to some as United Rentals (URI) is a bit of a value darling.

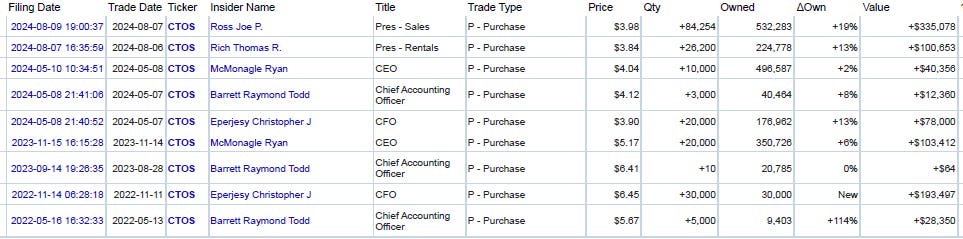

Management believes in the business, they even have engaged in inside purchases in the past. We usually don’t pay too much attention to CEO purchases, they are allowed to drink their own cool-aide, but we pay very close attention to CFO purchases, they are pessimists by nature and they know where all the bodies are buried. The CFO of CTOS has spent about $270,000 buying stock in the open market in 2022 and 2024. About two thirds of those purchases were at a stock price of $6.45, a bit higher than where it sits today at $5.97.

Perhaps one of the biggest drawbacks of CTOS, and perhaps the reason why value investors haven’t discovered this gem with a massive secular tailwind is that they aren’t returning capital to shareholders. Those profits have been plowed back into growing the rental fleet, and it’s not obvious at what point management believes the fleet will be large enough, and the debt is low enough, that some capital might be sent to the shareholders themselves. There’s a fantastic quote by Charlie Munger which sums up CTOS.

“We tend to prefer the business which drowns in cash. It just makes so much money that one of the main principles of owning it is you have all this cash coming in. There are other businesses, like the construction equipment business of my old friend John Anderson. And he used to say about his business, ‘You work hard all year, and at the end of the year there’s your profit sitting in the yard.’ There was never any cash. Just more used construction equipment. We tend to hate businesses like that.”

–Charlie Munger.

A business like Custom Truck One Source is a perfect example of a value degen pick, a speculative value play. On the one hand, you have a cheap business with an enormous secular tailwind that is likely to re-rate when the market discovers it. On the other hand, you have too much debt and no return of capital to shareholders. But with three years of organic growth and paying down debt, odds are good that CTOS has 2028 full year revenues of over $2.6 billion, and they trade at a price to sales of 1.5x, which would result in a stock price of $11.50. Going from $6 to $11.50 in three years would generate a 25% annual rate or return, give or take. And there is room for positive surprises, such as management doing a targeted buyback to retire some of those Platinum Equity shares, or the multiple expanding as high as 3x price to sales after a shift to free cash flow from the larger rental fleet.

Also, the value added from assembling the trucks means that the rental fleet is larger than the book value would indicate, as they transfer the assets to the rental fleet at cost. But there are things about CTOS that we don’t like compared to other equipment dealerships that don’t have direct exposure to the power grid theme. The best part of the dealership business is the parts and service revenue which tends to be the highest margin segment. CTOS only has around 7% of sales from parts and service (vs 68% of equipment sales and 25% of rental income), mostly because trucks that work on the grid travel far, and the number of mechanics who can work on trucks is fairly large. This means that CTOS will remain a lower margin business than some of its peers.

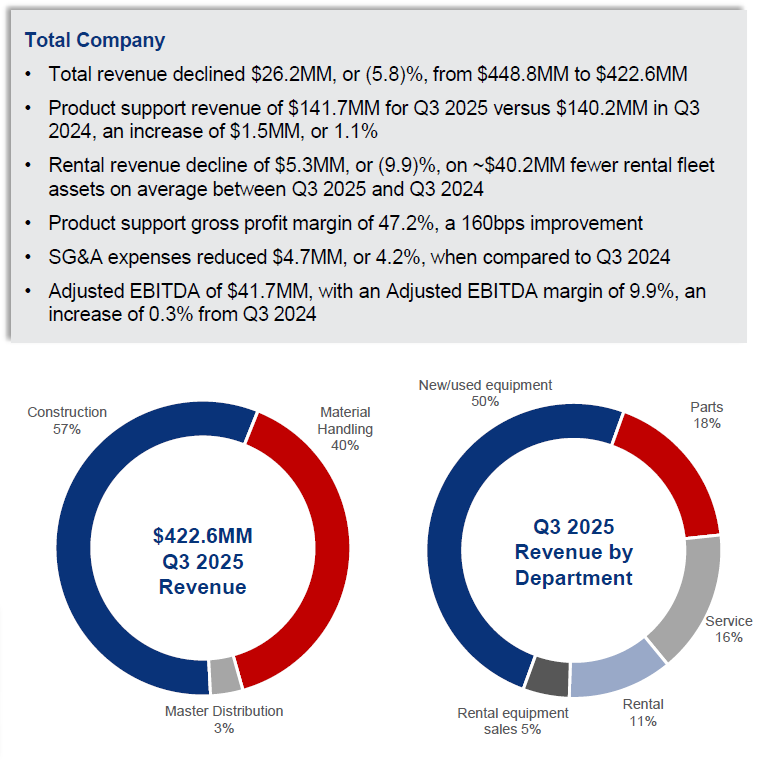

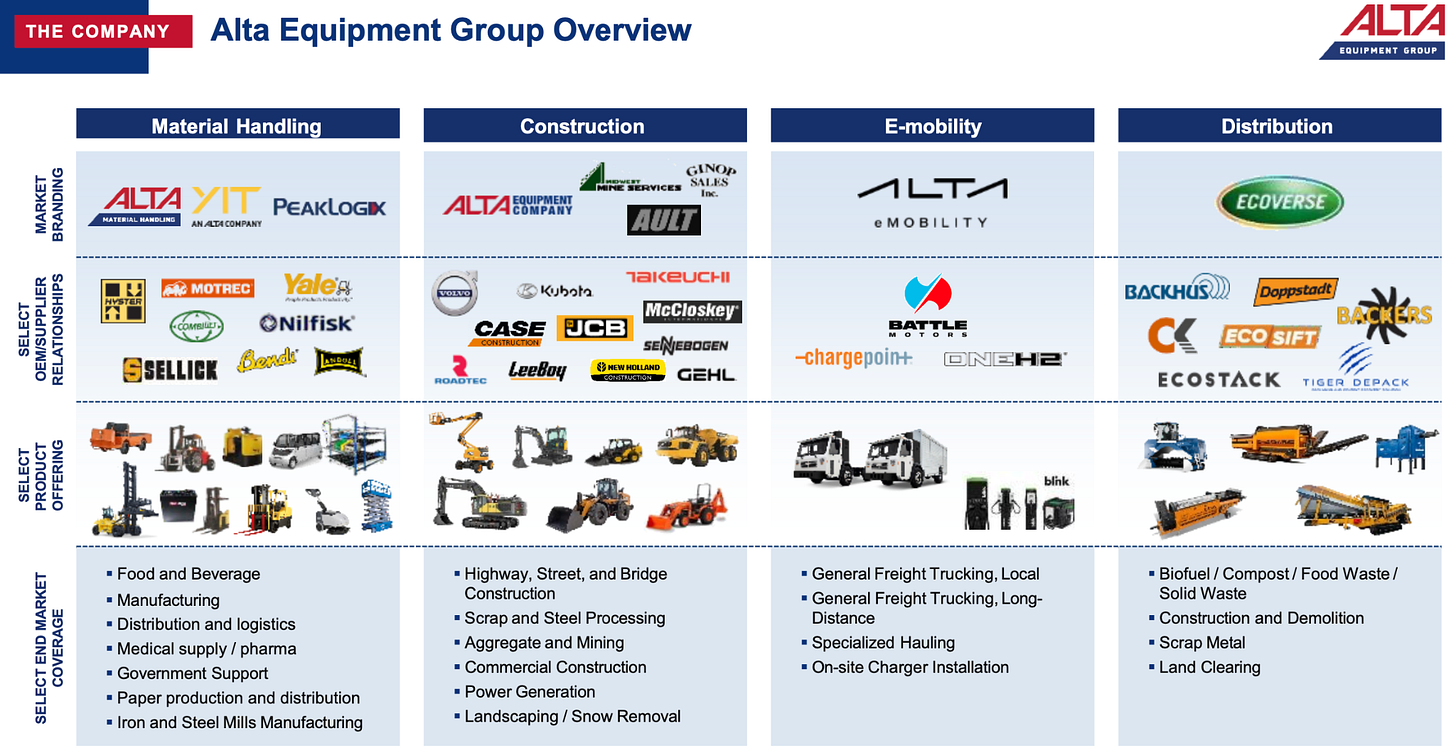

Alta Equipment Group (ALTG)

Unemployed Value Degen’s ALTG writeup:

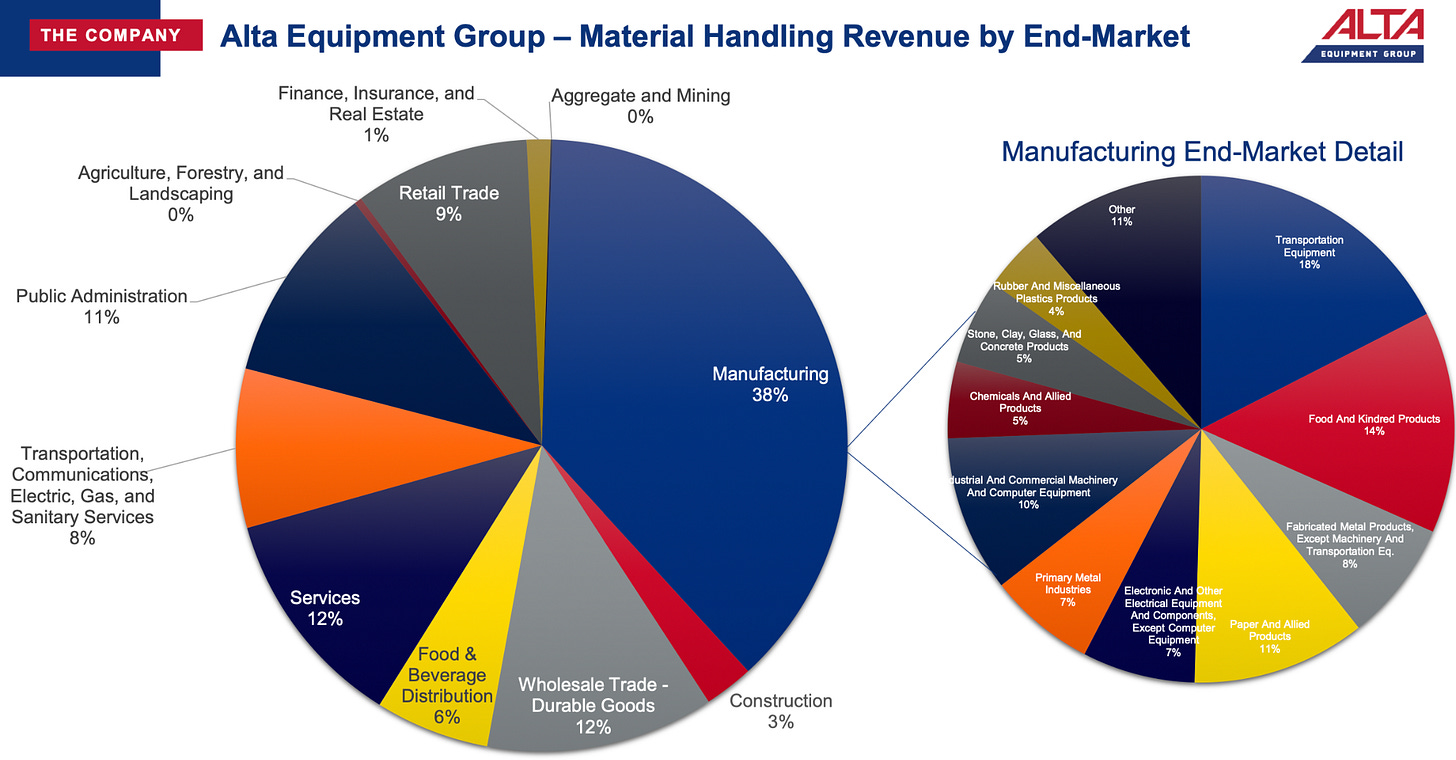

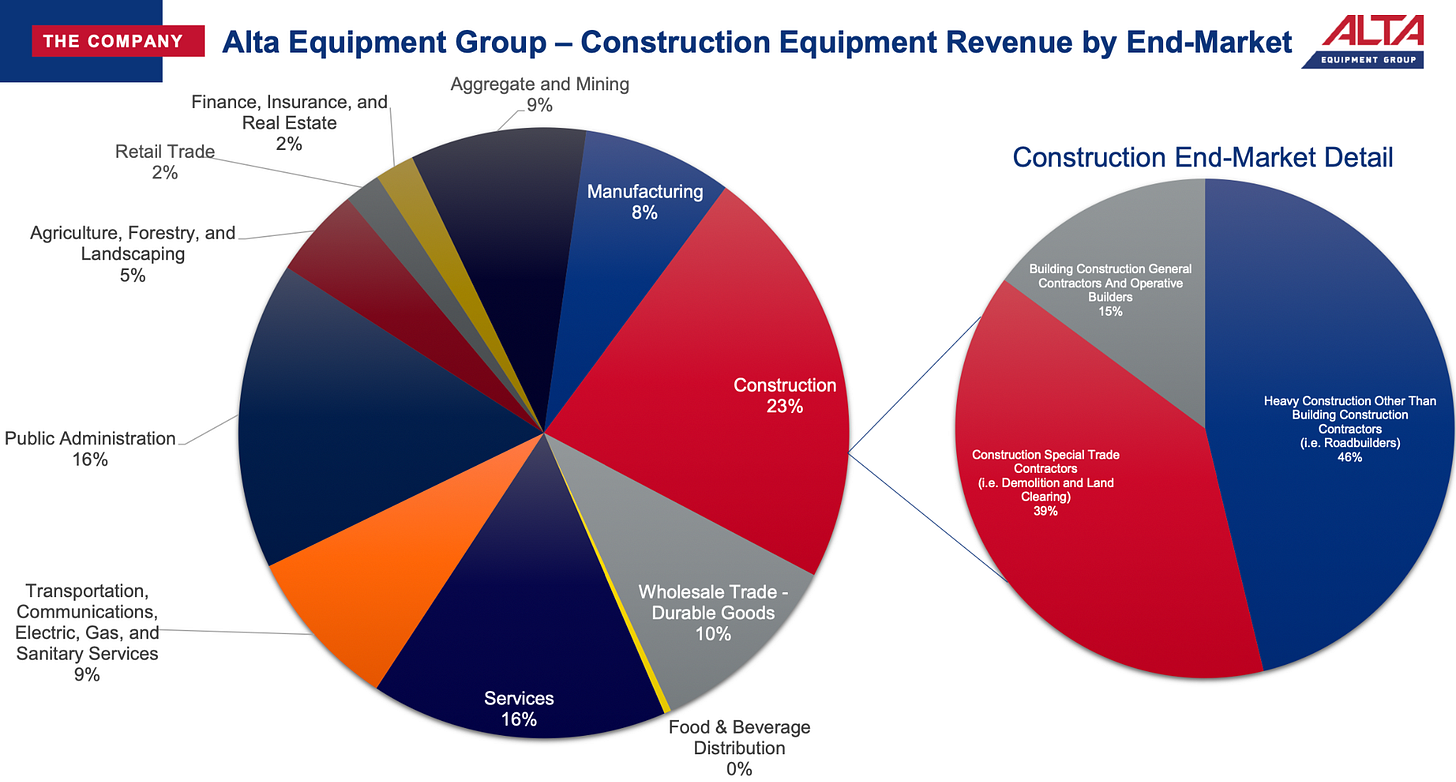

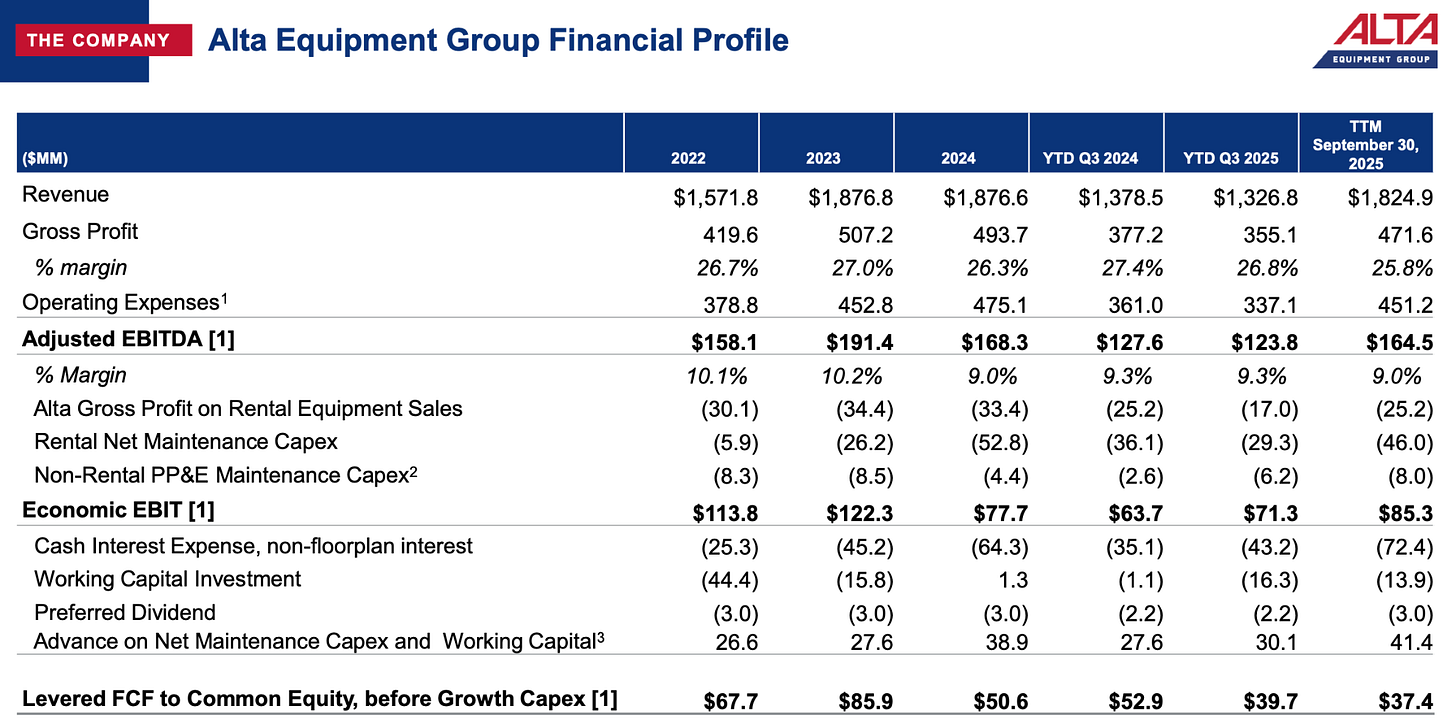

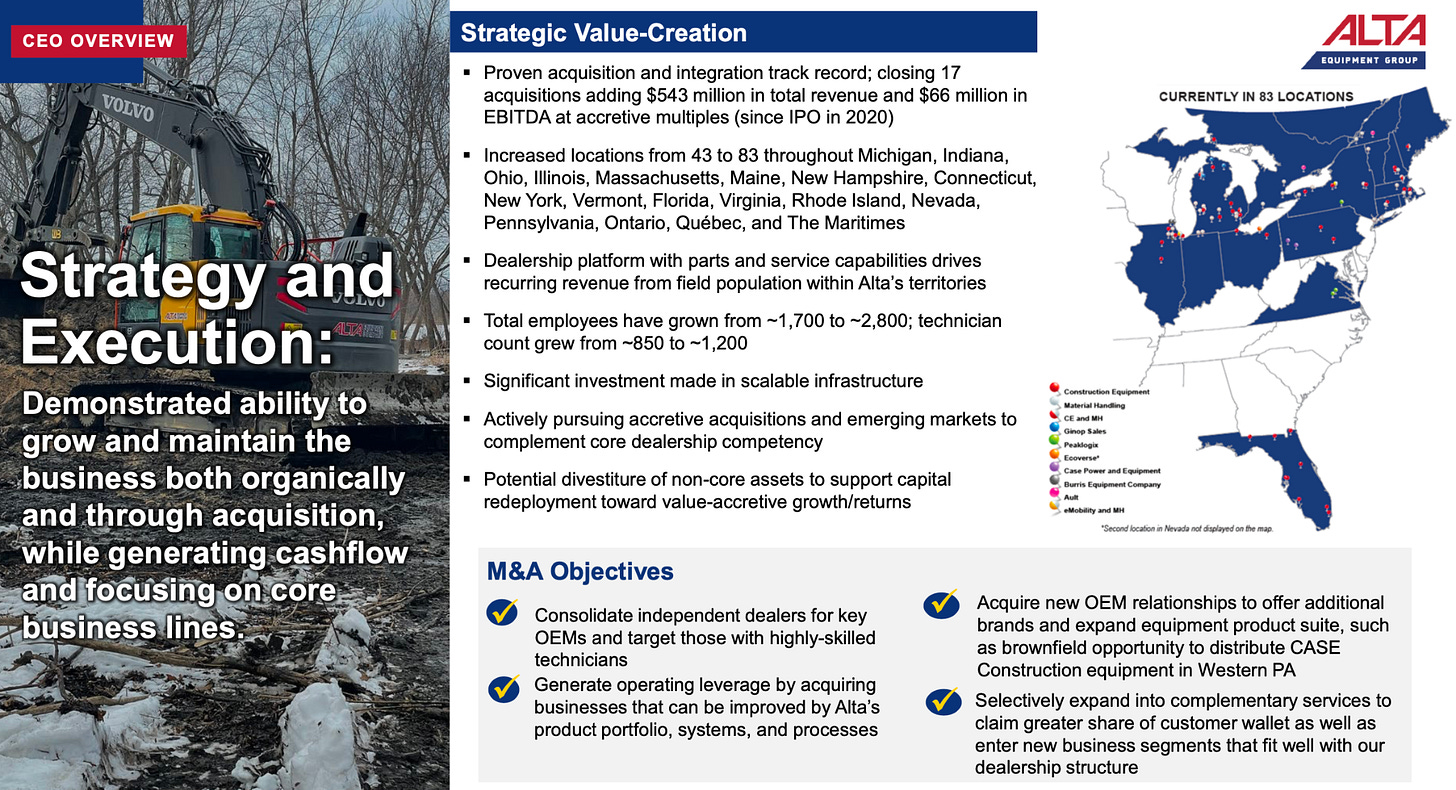

Unemployed Value Degen’s favorite dealership business, Alta Equipment Group (ALTG), might not have direct exposure to the power grid, but management has the optimal strategy, only acquiring dealerships that have regional monopoly rights for parts and service from top four OEMs in their niche. Many of those dealerships were acquired for 4x EBITDA in a region where the OEM has 10% market share compared to 25% nationally, meaning that over the next few years, sales should be able to grow in those new markets. ALTG’s parts and service revenue is 34% of the mix, and rental is only 11% of revenue compared to CTOS’ 25% of revenue from the rental business.

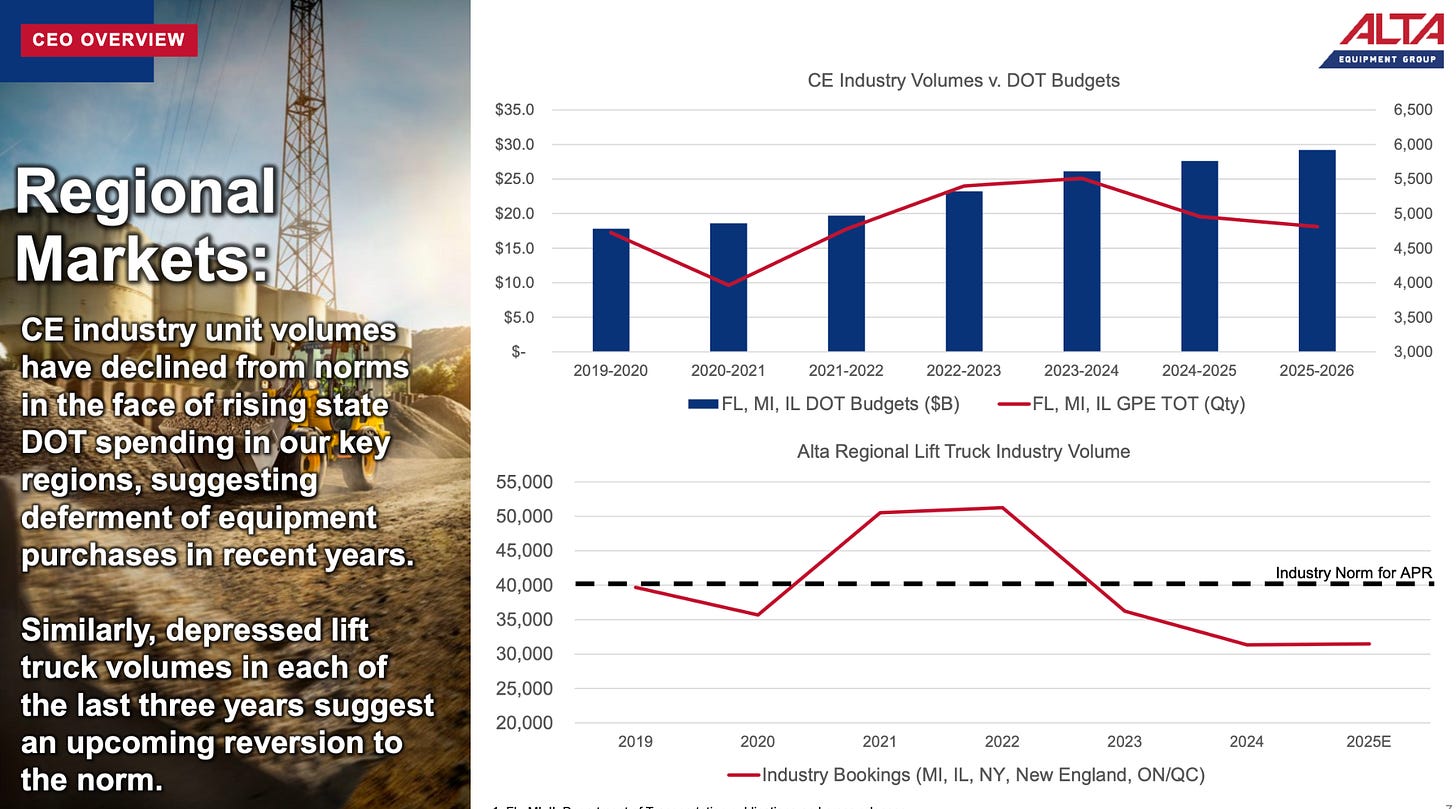

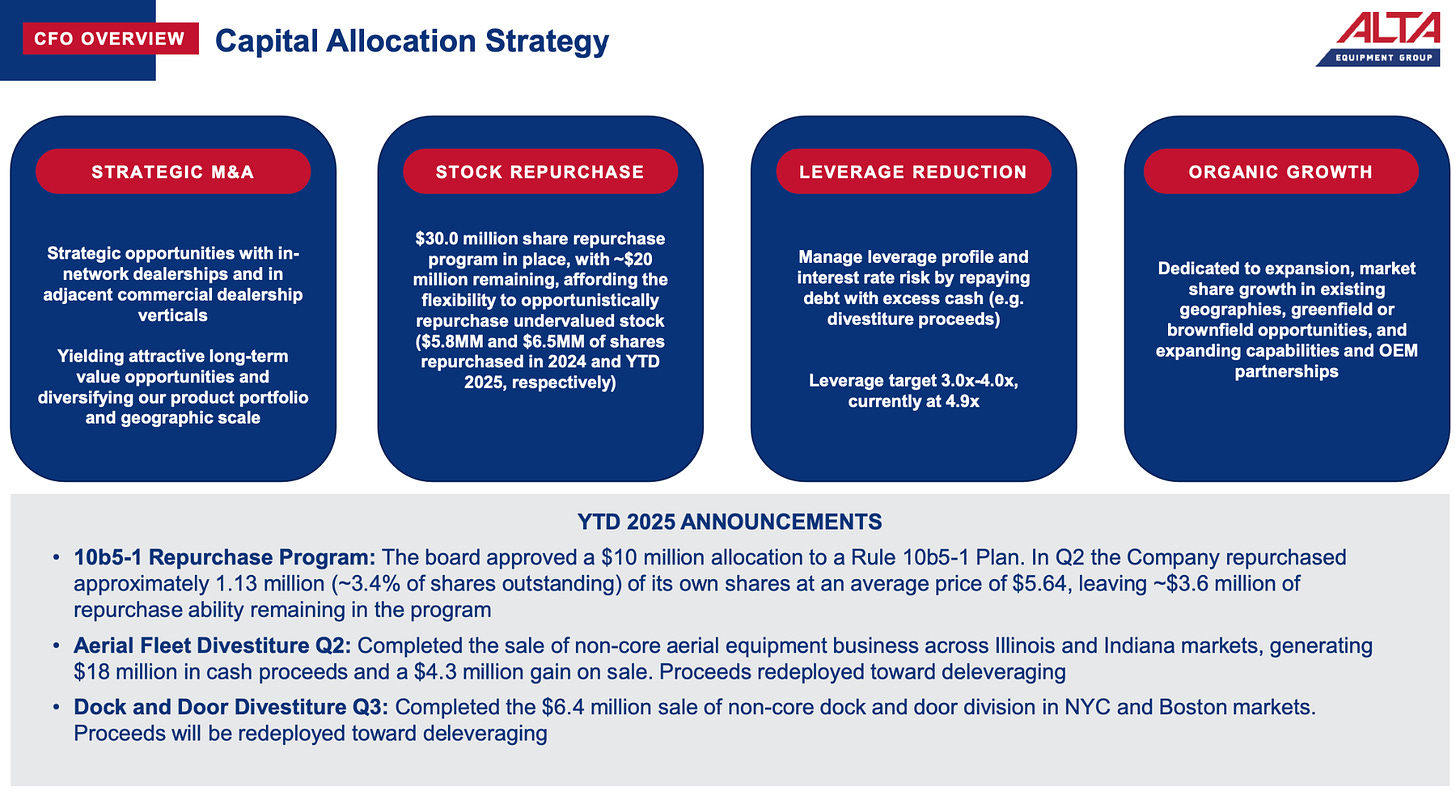

Alta Equipment Group has two major types of equipment, forklifts and construction. Instead of direct exposure to the grid, they have direct exposure to reshoring and infrastructure, both of which are still secular tailwinds, just less powerful tailwinds than the grid. And in exchange for slightly less obvious macro themes, ALTG is trading at a ridiculous 0.08x price to sales. Of course that low multiple is because GAAP net income has been negative for 2025, which is understandable given how the tariff shock caused enormous uncertainty and paralyzed capital deployment for all industries.

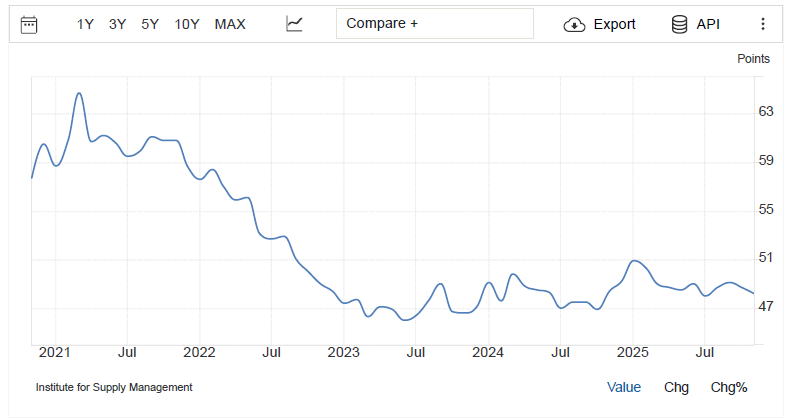

But coming into 2026, we have a lot of positive news for ALTG. We are likely to see tariff certainty as SCOTUS rules on tariffs, pent up capital projects begin being initiated, overnight interest rates fall even if the longer duration rates stay high, and most importantly for both ALTG and CTOS, Trump’s budget contained 100% accelerated depreciation for qualifying equipment (something that very few investors are paying attention to). Many market participants were surprised that the tariff uncertainty was more powerful in 2025 than the lure of the 100% accelerated depreciation, and yet here we are, with 2025 being very weak for equipment spending in the US. But we are coming off of a three year manufacturing recession, one of the longest on record, and odds are good that pent up activity is just roaring to go. Do we really expect ISM manufacturing PMI to stay below 50 when Trump is about to install a new Fed Chair, slash overnight rates, and run the economy hot into the midterms?

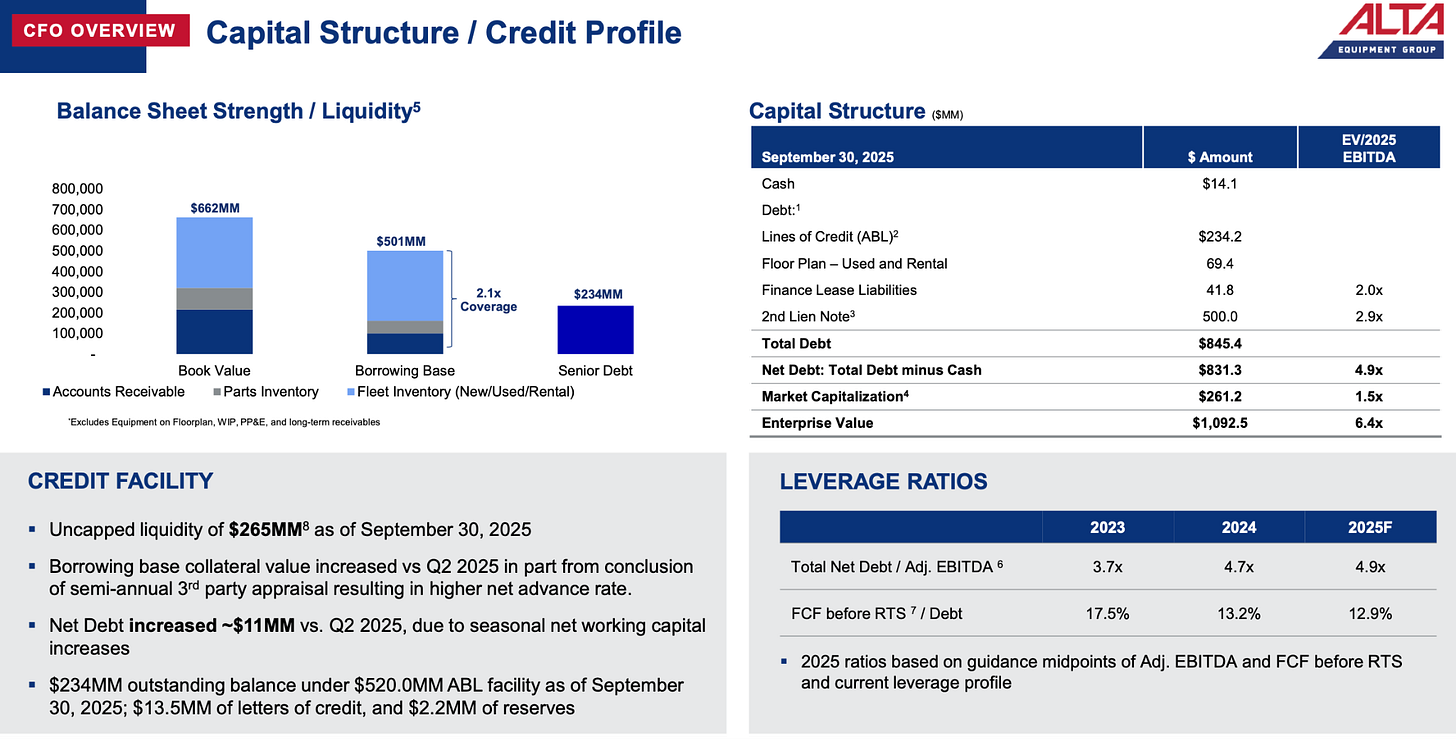

ISM Manufacturing PMI:

Regarding debt, ALTG is less levered than CTOS, but at a higher coupon as they refinanced the debt during the “higher for longer” moment. CTOS plans to make their inventory more lean and release some working capital, but ALTG has already done this. ALTG has $1.82 billion in trailing twelve month revenue, to CTOS’ $1.94 billion. ALTG is able to generate this revenue on $1.4 billion of assets, compared to CTOS’ $3.5 billion ($2.6 billion without goodwill), implying that ALTG is significantly more capital efficient. ALTG has about $750 million of long term debt to CTOS’ $1.6 billion, although ALTG has to pay a 9% coupon to CTOS’ 5.5%. Both have maturities in 2029. ALTG could benefit from refinancing at lower rates, CTOS would be unlikely to get a better rate than they got in 2021 when they issued the debt.

Unemployed Value Degen was able to get the CEO, founder and 18% owner of ALTG on Zoom for a call to understand their business better, and he likes it a lot.

Unemployed Value Degen’s ALTG management call summary:

He believes they have the perfect strategy for their business model, but talking to CEOs is dangerous as they are very good salesmen, and it is easy for an analyst to be taken in by their narratives. He was not able to get his email through the investor relations gatekeepers of CTOS in order to talk to someone. He thinks a lot of employees see an email from “Unemployed Value Degen” and click the delete button. But as his subscriber count has grown, getting through the gatekeepers is starting to get easier.

A coming multiple re-rating on the back of stronger macro and fundamentals:

ALTG is likely to trade up from a 0.08x price to sales multiple at least to between 0.80x and 1.00x when they have a solid year from these macro tailwinds and flip to GAAP net income profitability, growth, and pay down a bit of debt.

CTOS is likely to trade up from a 0.70x price to sales multiple to between 1.50x and 3.00x for the same reasons.

CTOS has the stronger theme, the grid, which was so strong that it overcame the macro headwinds of rising interest rates. ALTG has weaker themes which were overpowered by the macro headwinds of rising interest rates.

Both stand to benefit from the same macro supercycle, but through very different internal physics, the choice ultimately comes down to risk tolerance:

CTOS offers concentrated exposure and financial torque tied directly to utility capex, but with higher leverage and shareholder overhang risk.

ALTG offers diversification, capital efficiency, and aftermarket resilience, with near-term earnings pressure offset by refinancing optionality and stronger returns on capital.

CTOS for leveraged upside to the grid buildout. ALTG for structurally higher-quality earnings and capital discipline.

But both are about to enjoy tariff certainty and falling interest rates, implying that in the near term growth should inflect higher, even if only temporarily for two to three years. Perhaps CTOS is the better company to own for the next ten years, but the odds of ALTG being a ten bagger within the next 36 months are very good, and we don’t mind paying 20% capital gains tax on a ten bagger. We would want to sell our ALTG in anticipation of the next interest rate hiking cycle, but the grid theme may continue to be strong enough that CTOS could be a buy and hold through the cycle.

In many ways, CTOS is a bad business masquerading as a good business from the secular tailwinds, and ALTG is a good business masquerading as a bad business from the recent cyclical headwinds. But both are about to enjoy short term cyclical tailwinds to go along with their long term secular tailwinds, and add on some financial leverage and operating leverage and you have yourself some serious potential future gains.

Both companies are interesting, and should outperform the long run return of the S&P 500 over the next three years, if we are understanding the macro tailwinds and the themes correctly. But be forewarned, I did not anticipate that the selloff this past April from tariffs would be so severe, so our macro musings are as fallible as anyone’s.

In Unemployed Value Degen’s own portfolio, he has a 1% weight to CTOS and a 3% weight to ALTG. He owns both in the hope that if they pop at different times, he will be nimble enough to take profits from one and rotate to the other. He thinks he will probably not be that nimble.

2028 Price Targets:

Custom Truck One Source (CTOS) $5.96 to $11.50

Alta Equipment Group (ALTG) $4.72 to $49.75

Unemployed Value Degen’s ALTG price target video:

Looking Ahead To The Next Theme

There is one more major theme beyond the grid on which we both agree, that after three years of assuming that all software companies will be a zero due to AI, the time is finally here for the market to dig in case by case and see which companies are AI winners and which are AI losers. The valuations on software companies (especially small cap ones) are so cheap, that if we can correctly identify a few winners, they will be multibaggers, more than offsetting a few losers.

Unemployed Value Degen has only just begun his deep dive into small software, and it is a stretch for his circle of competence, but the cheese at the end of the maze is too pungent to ignore. So far he only has three ideas, and none of them are so enticing that he has more than a 1% portfolio weight.

Ozeco has covered why the whole Software space is not an AI loser and why we are merely early to the next tech supercycle in a recent deep dive. He covers the massive underperformance of software, the disruption debate and why those that store, process and control the data are misunderstood and too cheap. He argues that disruption risks dominate sentiment and that the market is not paying attention to the moats and potential revenue upside from AI products. Even large cap software names are now trading at historically low multiples, with Salesforce, the original SaaS company, being the prime example, which Ozeco has covered.

Crack The Market Software and AI - Why the Next Tech Supercycle Begins With Data:

Nerdy Inc (NRDY) is a tutoring platform, the old Varsity Tutors, but they are embracing AI and rolling out an AI assisted tutoring system. The CEO has quite smartly locked in long term contracts with a large number of public school systems, giving him the time and breathing room to hopefully win the market with the best AI platform. The financial results don’t reveal success yet, but the founder and CEO has bought so much stock in the open market that his ownership stake has gone from 15% to 45%, he truly believes he will win.

Unemployed Value Dgen’s Nerdy writeup:

ZipRecruiter (ZIP) is an online job portal which is embracing AI heavily to the extent that it even seems a bit foolish from the outside. AI will help job seekers write their resume, and AI will then help employers summarize those resumes, AI is talking to AI, all within the ZIP system. But employers seem to enjoy the new speed dating feature where initial interviews with qualified candidates can be conducted as quickly as the same day of a job posting. And regarding macro tailwinds, on the last earnings call there were some green shoots that hiring is starting to pick up. The narrative that AI is crushing the labor market might be false, tech was in year three of their year of efficiency, essentially firing all the HR hall monitors that were harassing productive employees, because AI meant that they could no longer rest on their laurels and participate in universal basic income for ivy league liberal arts graduates. Hiring was put on pause due to the uncertainty created by Tariff Liberation Day, and after three quarters, that uncertainty is wearing off and hiring can come back to normal levels.

Unemployed Value Dgen’s ZipRecruiter writeup:

LifeMD (LFMD) is an online telehealth platform, not so dissimilar to Hims & Hers, but with two important differences. LFMD made a strategic partnership with Medifast (MED) a gig economy version of Weight Watchers, where their tens of thousands of gig economy workers, mostly yoga instructors and personal trainers with a side hustle, could sign up customers for a weight loss program that included LFMD for a Wegovy prescription. For a year LFMD struggled with expensive brand partnerships against compounders which are now being targeted by lawsuits. Meanwhile, the price of branded Wegovy has dropped, and the new oral version has just been released. Second, people who downloaded the app were not able to be certain ahead of time that their insurance would cover the Wegovy prescription. Both of those problems are now turning into an opportunity, and this tiny health platform has a good chance of enjoying aggressive growth as about 20,000 gig economy workers start pushing their oral Wegovy in their yoga classes.

Unemployed Value Dgen’s LifeMD writeup:

Unemployed Value Degen’s search into AI winners and losers has only just begun, and in the following months there should be more to uncover. Again, it is a challenge for his own circle of competence, but where there will be multibaggers, he’ll give it the old college try.

Salesforce (CRM) is the original SaaS pioneer and one of the most influential growth stories in enterprise software, built on a decades-long secular shift toward cloud and recurring revenue. After a sharp reset in growth expectations, sentiment, and valuation, now trading 30 points cheaper than four years ago as growth slowed, Salesforce sits at the center of a fierce debate over whether software is GDP+ growth or on the cusp of its next AI-driven cycle.

Crack The Market Salesforce investment case:

Disclaimer: The information provided on this Substack is for general informational and educational purposes only, and should not be construed as investment advice. Nothing produced here should be considered a recommendation to buy or sell any particular security.