Ingredients: Reformulating the world - a resilient and high quality growth sector at an inflection point

The reformulation wave is coming and will meet the sector’s powerful growth engine

A few weeks ago, we reached out to Ozeco.

Why? Simple. We were fans.

So when he said he’d be open to collaborating, we jumped on it.

Then came his suggestion: “Why don’t we do a deep dive on ingredients companies?”

Milan (writing here) had to reread the message. Ingredients? Like... artificial sweeteners and protein isolates?

Not exactly what we expected. There hadn’t been a single neuron in my brain firing in that direction.

But then he sent over some of the research he'd already done.

And I have to admit, I was hooked.

These businesses are embedded in essential value chains across food, cosmetics, pharma, and beyond. They often sell specialized inputs with high switching costs. And they have pricing power that would make even luxury brands blush.

The more we dug, the more we realized: this sector might be one of the best-kept secrets in the public markets.

It’s underfollowed. Underloved. And, let’s be honest, a little boring.

But boring companies are often the best kind, especially when they quietly compound value behind the scenes.

And so, a new DualEdge x Ozeco deep dive was born.

In this piece, we explore the key characteristics that make ingredients companies so compelling: from their pricing power to their role as mission-critical suppliers. We dissect business models, margin dynamics, and valuation multiples. We also highlight some standout names, dig into market trends, and tackle the biggest risks investors need to watch for.

So... what the hell are ingredients companies?

No shame if you had to Google it. We did too.

Because when most people hear “ingredients,” they think flour, sugar, maybe that overpriced vanilla extract in your kitchen drawer. But the ingredient world we’re talking about here? That’s a whole different game.

Ingredients companies make the stuff behind the stuff.

They’re the invisible engineers of modern consumer products — designing the flavors in your fizzy drink, the lavender note in your shampoo, the protein boost in your oat milk, the shelf life in your painkiller. From taste to texture, from fragrance to function, they’re the reason a product works (or sells) the way it does.

But here’s the kicker: you’ll never see them on a label.

That invisibility is by design. Ingredients companies operate strictly B2B. They supply behind the scenes to the world’s biggest brands — Nestlé, L’Oréal, Coca-Cola, P&G — often co-developing products in secretive partnerships. Their compounds are proprietary, heavily regulated, and often the result of years of R&D. Some are extracted from plants, others grown in vats using cutting-edge biotech.

And yet, for something so hidden, this industry is absolutely massive.

We’re talking tens of billions in revenue. Dominated by a handful of giants (Givaudan, Symrise, IFF…), but with a long tail of specialized players quietly compounding away. Think of it as a high-margin corner of the market where boring meets beautiful.

Why is this its own industry?

Because it doesn’t behave like anything else.

Ingredients aren’t just a sub-sector of chemicals. Nor are they just a footnote in the food or cosmetics supply chain. They’re a standalone, high-value vertical, sitting at the crossroads of chemistry, biology, and consumer trends.

They offer the kind of structural advantages investors dream about:

Recurring revenue from sticky customer relationships

Non-discretionary end demand

Low capital intensity but high IP content

Long-term secular tailwinds (natural reformulation, health focus, biotech innovation)

Oh, and they often control pricing.

Which is wild when you consider that their compounds typically account for <5% of the final product’s cost but 80% of its “wow” factor. That vanilla note? It sells the ice cream. The emulsifier? It makes the lotion feel luxurious. Try swapping it out. Your customer notices. And churns.

So yeah, this sector might be obscure. But once you see it, you can’t unsee it.

And once you’ve tasted the margin structure... you might never look at another consumer stock the same way again.

How They Make Their Money

So what exactly do these companies do?

They don’t grow the vanilla. They don’t fill the shampoo bottle. But they do everything in between — and that’s where the magic (and margin) lives.

Here’s the simplified playbook, with real-life flavor:

Procurement

They start by sourcing raw materials from thousands of fragmented suppliers around the world.

Think: patchouli leaves from Indonesia, seaweed from Brittany, chili extract from India, or enzymes from a biotech lab in the Netherlands.Isolation & Purification

Next, they extract the specific active compounds from those materials.

For example: separating the molecule that gives chili its heat (capsaicin), or isolating the exact protein from peas that improves texture in plant-based burgers.Creation & Compounding

Now the fun starts. Chemists and flavorists mix those isolated ingredients into proprietary blends.

Imagine a “meaty” aroma for a vegan sausage, or a mix that gives lotion its light, silky feel without being greasy. These blends are IP-protected and often tailor-made.Encapsulation & Stabilization

These mixes need to survive the supply chain — heat, pressure, UV light, you name it.

So they get wrapped in microscopic capsules or combined with stabilizers.

That’s how a mint flavor stays minty in chewing gum for two years without degrading.Application Testing & Co-Development

Before anything ships, it gets tested in real-world use.

Ingredient firms work hand-in-hand with Unilever, Nestlé, L’Oréal, etc., tweaking dosages, textures, and even how the scent “blooms” in the shower.

It’s like R&D speed-dating.Global Delivery & Support

Finally, the finished compounds get delivered — on time, across the globe, with high reliability.

And if Nestlé wants a minor tweak for the Brazilian market? There’s a technical rep on standby.

This isn’t raw commodity trading. It’s high-touch, high-IP, and often fully embedded in a customer’s production process.

Want to switch to a competitor? You’ll need to reformulate, re-test, re-certify, and maybe even retrain your plant staff. Most just don’t bother.

That's how ingredients companies quietly build moats. One blend, one relationship at a time.

How good is their performance?

Historically, these companies have grown at mid-single-digit rates, driven mainly by volume. But 2021–2022 changed that. With input costs spiking, many players rewrote their client contracts to include cost indexation clauses. Pricing suddenly became the main growth lever.

This not only helped margins — it proved the embedded pricing power of these companies. After all, if your product is 2% of the total cost but 80% of the end experience... why wouldn’t you push prices?

Going forward, consensus expects +3–4% annual growth, with volume gradually resuming its leading role.

Why They Outgrow Their Own Clients

Here’s the twist: tier-1 ingredients players often outpace the growth of their FMCG customers.

Why?

Because ~66% of their revenue comes from SMID clients (small- and mid-cap brands), who:

Grow faster

Pay more

Innovate quicker

These challenger brands are launching collagen smoothies, mushroom coffees, and algae-based serums — and they need specialized, agile partners who can co-create fast.

That puts ingredients companies in a sweet spot: exposed to broad consumer trends, without being tied to the slow category dynamics of big staples.

Margin Machinery

Margins vary across players — but not randomly. The key drivers are:

Product mix: more specialized = more profitable

Scale: global networks bring efficiency

Cost management: especially in sourcing and logistics

These aren’t asset-heavy giants. They’re knowledge-driven platforms, mixing chemistry, logistics, and long-term contracts into a steady stream of free cash.

And if that doesn’t scream underrated alpha, we don’t know what does.

How does the competitive landscape look like?

Let’s get one thing straight: this isn’t your average commodity business.

You can’t just rent a warehouse, order some aroma chemicals from Alibaba, and start elbowing Givaudan off the shelf.

Ingredients companies don't just have a moat — they’ve got a full-blown fortress, patrolled by regulatory dragons and guarded by perfumers with PhDs.

Let’s start with the obvious: this market is tight. The Aroma, Flavors & Fragrances (AFF) segment alone is worth over €40 billion. And four companies control two-thirds of it. That’s not a typo. That’s a cartel.

But here’s what really matters: almost nobody ever leaves.

Once you’re in a customer’s formula, you're basically part of their DNA. Swapping you out would mean reformulating the entire product, navigating regulatory landmines, retraining internal teams, and risking customer backlash when the shampoo doesn’t smell quite like it used to.

And since ingredients make up a tiny slice of the customer’s cost base — often just a few percentage points — there's little incentive to switch, even if a competitor offers a slightly lower price.

That stickiness is golden.

Then there’s the skill gap.

The real magic in this sector comes from deep expertise: molecular engineering, fermentation technology, application testing across food and personal care, regulatory know-how, and — let’s not forget — trained perfumers, which are as rare as left-handed unicorns. This is not a plug-and-play industry.

Translation: you don’t just waltz into this market.

And it shows in how competition works.

Even existing players rarely go head-to-head on the same products. The real battle is in new product development — roughly 20% of the business — where speed, creativity, and co-development matter more than cost.

Then there’s the supply side. Most ingredients companies source raw materials from small regional farmers. Think vanilla pods in Madagascar or patchouli leaves in Indonesia. That gives the big players serious pricing power upstream.

Downstream? It depends. Regional customers get little say. Global giants have more leverage — but even then, pricing structures have evolved. Contracts are more dynamic now, with built-in clauses for raw material, logistics, and energy inflation. And if input costs spike? No problem. Ingredients players pass those on — with a 6 to 12-month lag.

In short, this is a sector where:

Customers rarely churn

Suppliers can’t negotiate

And the product, once embedded, is practically irreplaceable

All wrapped in an industry where innovation is slow, barriers are high, and everyone’s too busy co-developing the next collagen peptide to start a price war.

We told you boring was beautiful.

Meet the Giants — A Quick Tour of the Ingredient Titans

After all that talk about moats, margins, and market fragmentation, you might be wondering: who’s actually sitting on the throne?

Well, this isn’t a one-king kind of kingdom. The ingredients world is led by a handful of diversified giants — each with their own specialty, history, and strategic edge.

Let’s break them down:

Novonesis – The Biotech Powerhouse

Born from the merger of Novozymes and Chr. Hansen, Novonesis is a biosolutions specialist with deep roots in fermentation, enzymes, and probiotics.

Think of them as the lab coat of the industry — heavily science-driven, with a focus on food, agriculture, and sustainability. Their expertise in industrial and microbial biotech makes them a unique player in a market still dominated by sensory and flavor incumbents.

DSM-Firmenich – The Science-Led Synthesizer

Formed in 2023 by the merger of Dutch DSM (biosciences and nutrition) and Swiss Firmenich (fragrances and flavors), this is one of the most diversified players in the game.

They span vitamins, flavors, fragrances, and functional health, all with a heavy R&D footprint.

Positioned as a global sustainability leader, DSM-Firmenich blends deep science with strong branding capabilities — ideal for the health-conscious and premium-driven consumer trends of the 2020s.

Symrise – The Quiet Compounder

German efficiency meets steady innovation.

Symrise focuses on flavors, fragrances, and cosmetic actives, with notable exposure to pet nutrition.

They’re known for their consistent organic growth, a high degree of co-development with clients, and a strong track record in natural and sustainable sourcing.

Less flashy than others — but often more reliable.

Givaudan – The Crown Jewel

The undisputed heavyweight of fragrance and flavors, Swiss-based Givaudan is often referred to as the “LVMH of ingredients.”

They operate across fine fragrance, beauty, taste, and wellbeing — always at the premium end of the market.

What sets them apart? Deep client relationships, relentless innovation, and a knack for staying irreplaceable in high-stakes formulations.

If you’ve ever fallen in love with a perfume or a snack, chances are Givaudan had something to do with it.

IFF (International Flavors & Fragrances) – The American Generalist

New York-based IFF is a broad-spectrum player — covering taste, scent, nutrition, and health.

The 2021 acquisition of DuPont’s Nutrition & Biosciences arm expanded their reach into enzymes, cultures, and texture solutions, giving them a major industrial edge.

While not the fastest grower, they boast an unmatched breadth of portfolio, making them a strategic partner to both legacy FMCG and emerging food-tech brands.

Over the coming weeks, Ozeco will be covering Novonesis and Symrise, two of the highest quality ingredient companies and will look at other ingredient companies over time. So don’t forget to subscribe!

Innovation at the Core — R&D as a Growth Engine

Let’s get one thing clear: these companies aren’t just industrials with a scent.

They’re R&D machines in disguise.

On average, top players spend 4–11% of revenue on R&D — that’s higher than most consumer brands they serve. Novonesis tops the list at 11%, followed by Givaudan, DSM-Firmenich, IFF, and Symrise, all sitting comfortably above typical industry norms.

Why the heavy spend?

Because 20% of their revenue comes from innovation — i.e., new formulations, new applications, new textures, new health claims. When Unilever wants a shampoo that’s sulfate-free and smells like wild peach and foams like a dream, guess who they call?

R&D priorities are clear:

Healthier solutions: less sugar, less fat, more protein — but still tastes amazing.

Natural ingredients: locally sourced botanicals, plant-based emulsifiers, and other crunchy-sounding things that make the label cleaner.

In short, ingredient companies are quietly riding the same secular waves as their clients — health, wellness, clean label, functionality — but from a much better strategic position.

They don’t have to predict which brand will win. They sell to all of them.

M&A — The Quiet Portfolio Shuffler

R&D might drive organic growth. But when it comes to scaling fast or entering new domains? M&A does the heavy lifting.

Most ingredient companies have been consistently acquisitive over the past decade — buying niche specialists, regional champions, and biotech innovators.

The rationale? Simple:

Expand production capacity (especially in high-growth or emerging markets)

Expand geographic reach (new regions = new clients = new tastes)

Enter adjacencies (pet food, enzyme tech, microbiome, gut health)

But let’s be clear: we’re not talking about empire-building.

The current environment is more about bolt-on acquisitions — no appetite for big-bang deals right now. Management teams are focused on volume recovery, operational discipline, and incremental expansion. Think: €100m tuck-ins, not €5bn headline grabbers.

Still, M&A remains central to the long-term game. Because the market is fragmented, talent is scarce, and innovation is often locked in small, science-heavy teams. Buying them? Sometimes faster (and cheaper) than building in-house.

Sector Outlook: Tailwinds, Turbulence, and the Natural Revolution

Let’s not beat around the (vanilla) bush — ingredients have long been a solid, under-the-radar compounder.

But the next decade? It might just be their breakout phase.

The long-term drivers are powerful and sticky:

A generational shift in consumer preferences

A rising middle class in emerging markets

And a broad global push for natural, healthy, traceable inputs in everything from food to fragrance: The Reformulation Opportunity

Reformulation Nation: The U.S. Opportunity

In the United States, reformulation isn’t just a health trend — it’s a strategic unlock.

Consumer expectations are shifting. Regulators are tightening. Retailers are curating. And across food, cosmetics, and even pharma, brands are being forced to revisit their old formulas — quite literally. The ask? Less sugar. Less sodium. No artificial nonsense. But the product still has to taste, smell, or feel exactly like the consumer remembers.

That’s not easy. But it is profitable.

Why Reformulate?

For food companies, reformulation is no longer optional. It's a proactive way to stay ahead of regulation, boost ESG scores, and win space on premium retail shelves — think Whole Foods or Target’s “clean label” aisles. In personal care, it's all about clean beauty: products free from controversial ingredients, but still luxurious and sensorial. Even in pharma, reformulation has strategic value — older drugs are being relaunched with improved delivery methods or updated ingredients, extending shelf life and meeting evolving consumer preferences.

What’s in It for Ingredients Players?

A lot, actually. Reformulation isn’t just about removing the bad stuff — it’s also about adding better alternatives. This is where ingredients companies shine. They offer the building blocks for cleaner, healthier, and more functional products: natural preservatives, plant-based emulsifiers, precision flavor enhancers. The kind of inputs that let brands modernize without having to reengineer their entire production lines.

The complexity of reformulation creates stickiness. Brands need ingredients that don’t just meet new standards, but also maintain — or improve — consumer experience. That makes suppliers with the right capabilities indispensable.

The Strategic Bottom Line

In the U.S., reformulation has moved beyond fad status. It’s become a core lever for relevance and growth. It blends regulation, consumer demand, and brand strategy into a single, high-impact initiative. For ingredients companies, this is a structural tailwind that’s only getting stronger. Those who can help clients reformulate faster — without sacrificing product experience — are perfectly positioned to lead.

But there is another innovation that is revolutionizing the sector: GLP-1drugs

The Ozempic Effect — Appetite Meets Innovation

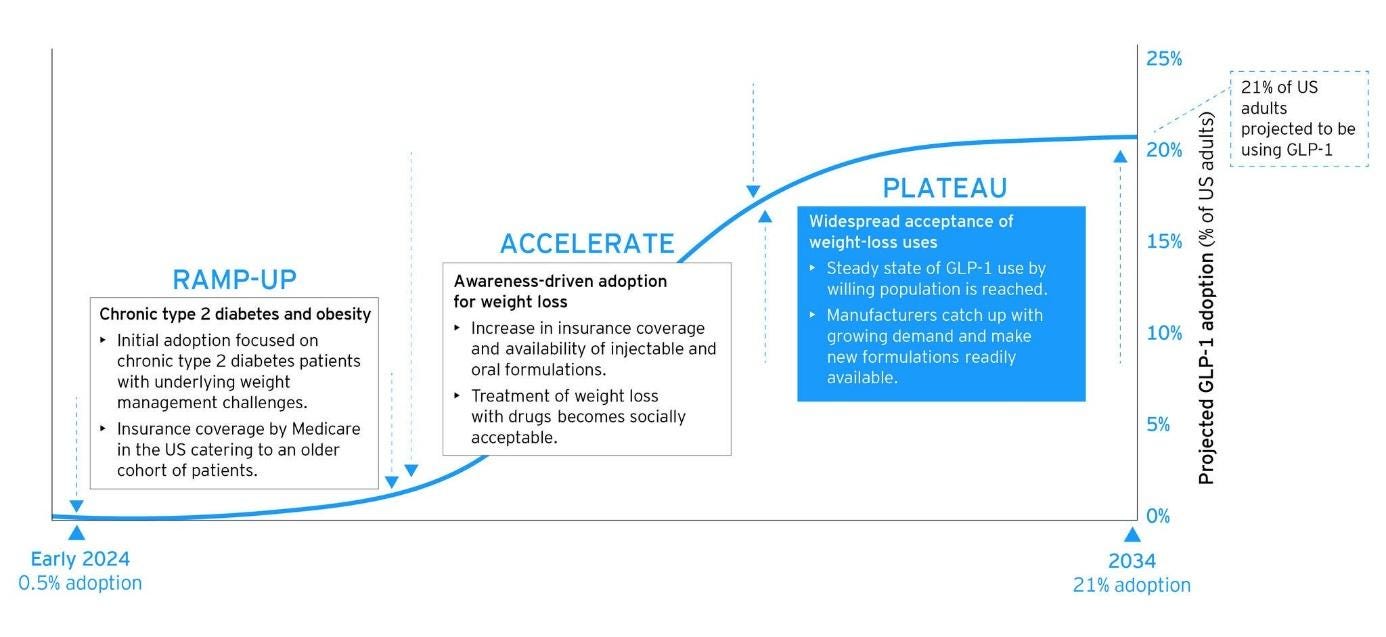

A new and unexpected factor has entered the demand equation: the rise of GLP-1 agonists — weight loss medications like Ozempic and Wegovy.

Originally developed to treat diabetes, these drugs are now widely used to suppress appetite. And the impact is becoming tangible. Supermarkets and snack manufacturers have already reported lower sales volumes in demographics with high GLP-1 adoption. What used to sound like sci-fi — eat less, feel full — is now showing up in the data.

Studies suggest that GLP-1 users spend 6–9% less on food compared to similar non-users. EY-Parthenon estimates that widespread use could reduce global snack market growth by $12 billion in the coming years.

Even more striking: EY expects that by 2034, around 20% of U.S. men could be using GLP-1 drugs. That’s not just a diet trend — that’s a structural shift in consumption.

Still, we’re only in the early innings. The long-term impact is hard to pin down — adoption curves, regulatory responses, and consumer behavior are all still in flux. But the direction of travel is clear.

For ingredients companies, this creates potential volume pressure in calorie-dense categories like sweets, snacks, and processed foods. Lower consumption equals lower production — and fewer inputs needed.

But it’s not all bad news.

As consumers shift from quantity to quality, there’s growing emphasis on nutrient density per bite. This favors ingredients companies that specialize in functional and nutritional components — like proteins, fibers, and vitamins — as well as those able to deliver stronger taste experiences in smaller portions.

Suppliers are already co-developing reformulations for a lower-intake world: nutrient enrichment to avoid deficiencies, intensified flavors to make less feel like more, and tailored solutions for emerging categories like medical nutrition and low-calorie formats.

The Ozempic effect isn’t a catastrophe — but it’s also no passing fad. Few pharma trends ripple this hard through the food value chain. For now, it’s a risk worth monitoring — and a shift smart players are already adapting to.

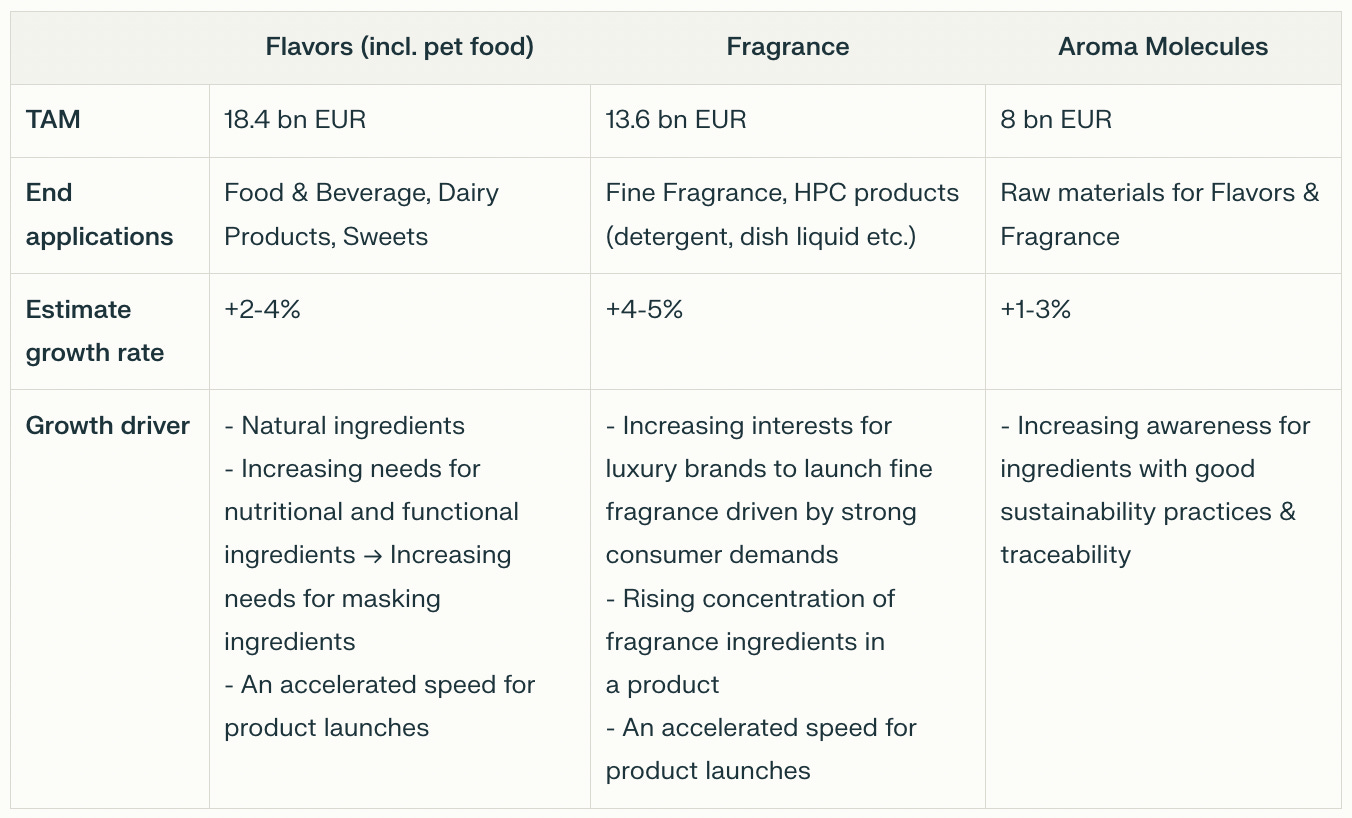

Flavors & Fragrances: Where the Action Is

Nowhere are these shifts more visible than in Flavors & Fragrances (F&F), where the move toward natural ingredients is accelerating fast.

In flavors (food & beverage), natural inputs already make up ~80% of the market.

In fragrances (perfume, cosmetics, home care), it’s more like 20–50% — but growing fast as consumer scrutiny intensifies and regulators crack down on synthetic nasties.

The result?

F&F has been the fastest-growing slice of the ingredients market, clocking in at +8.7% annual growth before the 2022 slowdown — nearly double the industry average.

And that outperformance is expected to resume once the current destocking cycle plays out.

It’s Not All Rosy — Natural Comes With Baggage

Natural sounds great... until you try to scale it.

Here’s the reality:

Supply chains are messy: sourcing vanilla or patchouli is weather-sensitive, price-volatile, and logistically complex.

Product design is trickier: shelf life drops, taste or scent can shift batch-to-batch, and you might need preservatives (which kind of defeats the point).

End-demand is more elastic: natural usually means pricier, and in a tight macro, some consumers just trade down.

In short: natural is the future, but it’s not frictionless.

That said, the companies that master this complexity —through better R&D, agile sourcing, and tight customer integration — will be the ones earning outsized returns.

Margin Dip Today, Margin Boom Tomorrow?

Margins in F&F have taken a hit recently — think 15–20%, with Symrise sitting near the low end. That’s mostly a function of weak end-market demand, inflationary input costs, and pricing that hasn’t fully caught up.

But don’t let the current dip fool you.

Structural margin expansion is still in play.

As natural formulations mature and pricing normalizes, long-term EBITDA margins north of 20% are back on the table — especially for those with scale, proprietary IP, and sticky client relationships.

If you only look at share prices, you’d think this sector was in structural decline.

It’s not.

What we’ve actually seen over the past five years is a textbook case of macro whiplash meets cyclical overreaction — all layered on top of a sector with quietly improving fundamentals.

Let’s walk through the recent drama:

2020–2021: The High

The good times rolled.

Consumers were flush with stimulus cash. Supply chains were a mess. Brands scrambled to secure inventory. And ingredient companies? They cashed in — both on volume and pricing.

Clients over-ordered to hedge inflation risk. Governments subsidized demand. Everyone was a winner.

2022–2023: The Hangover

Then came the unwind.

Destocking started late 2022 and went into full force in 2023. Volume fell off a cliff as brands burned through inventories and consumers traded down to cheaper goods. Revenue held up better (pricing helped), but margins took a hit.

Input costs stayed high. Operating leverage worked in reverse. And investors started to question if the magic had run out.

2023–2024: The Recovery

But the magic was just... hiding.

Destocking eased. Input cost inflation cooled. Volumes returned to moderate single-digit growth. Margins began to recover. And most companies leaned into cost-saving reformulation, a client priority that played right into their hands.

Innovation picked up again (clean-label, sugar/fat reduction), but M&A activity stayed muted.

For a brief moment, it looked like the market had noticed: share prices rebounded. All was well.

2024–2025: The Selloff (Again)

Until it wasn’t.

From Q4 2024 onward, the sector got hit again — this time by macro fears:

Profit-taking after a strong year

US election jitters (hello, tariffs)

Concerns over the consumer (GLP-1, downtrading)

Rising bond yields (growth sector = duration risk)

It was less about company performance, more about narrative rotation. And the market didn’t wait for nuance.

So Where Are We Now?

That’s the real question.

Because Q1 2025 earnings came in strong. Destocking is largely behind us (except in pet, pharma, ag). Pricing is normalizing. But volume is back. And margin improvement is underway — powered by both demand recovery and cost discipline.

Valuations, meanwhile, have reset. Some names are trading at multi-year lows, despite clearer growth visibility and stronger balance sheets than ever.

In our view? This setup is asymmetrically attractive.

The near-term noise is masking the fact that ingredients companies are entering a new growth phase — one driven by secular trends, disciplined operations, and a bit more humility after the 2020 sugar rush.

That’s not just recovery. That’s opportunity.

Valuation: Defensive Growth at a Discount?

Let’s talk price tags.

There are two main ways to value ingredients companies — and both are flashing green right now.

1. Relative to Their Own History

On a sector level, ingredients stocks are trading at 15x NTM EBITDA and ~23x PE.

Those are multi-year lows, only seen during moments of real market stress — think: the pandemic sell-off, or the depths of the 2022–2023 destocking panic.

Back then, volumes collapsed and the market feared a structural shift. Now? Volumes are recovering, margins are improving — but valuations haven’t caught up.

In other words: we’re still pricing in pain, long after the bleeding stopped.

2. Relative to Staples — The Smarter Benchmark

Here’s our preferred lens: comparing ingredients to consumer staples, their end customers.

Why? Because both are defensive, both serve non-discretionary demand, and both benefit from long-term brand relationships.

But one grows faster.

Historically, the ingredient sector has traded at a ~40% premium to staples on EV/EBITDA — justified by its superior top-line growth and margin potential.

Today? That premium has shrunk to just 20%.

And that’s despite ingredients companies:

Having more pricing power

Being earlier in the innovation chain

Recovering from destocking

And holding up better in inflationary environments

That’s not just a valuation gap. That’s a setup.

The Bull Case Is in the Blend

To sum it up: you’re getting a sector that combines the resilience of staples with the growth optionality of biotech — but priced like it’s stuck in no man’s land.

That doesn’t happen often.

And when it does, you don’t need multiple expansion to make money. You just need normalization.

Risks: What Could Go Wrong?

Of course, no moat is immune.

First, there’s input volatility. Many natural ingredients are still exposed to erratic agricultural cycles and geopolitical shocks — think vanilla from Madagascar or citrus oils from Brazil. When supply tightens, costs soar. And while most companies can pass that through, it’s rarely clean or immediate.

Second, regulatory overhang. The same clean-label movement that drives growth can also backfire. One new EU directive or FDA shift can render an entire formulation obsolete — and navigating compliance across food, cosmetics, and pharma simultaneously is no small feat.

Third, customer concentration. Many ingredients players still rely heavily on a few mega-clients. That means pricing power can flip fast — especially in a world where FMCG giants are trying to optimize margins and build in-house capabilities.

Fourth, innovation risk. As the sector evolves, staying relevant requires constant investment in biotech, AI-assisted formulation, and sustainability-linked design. Companies that fall behind technologically may struggle to win the next generation of reformulation contracts.

Finally, integration risk. Ingredients companies are no strangers to M&A — but integrating niche or science-heavy acquisitions can be messy. Cultural mismatches, tech misalignment, or failed synergy realization can quietly erode returns. And with many players running lean, even small hiccups can ripple through operations or delay product pipelines. As the sector evolves, staying relevant requires constant investment in biotech, AI-assisted formulation, and sustainability-linked design. Companies that fall behind technologically may struggle to win the next generation of reformulation contracts.

In short: margins are healthy, moats are real — but this isn’t autopilot territory.

Disclaimer: The information provided on this Substack is for general informational and educational purposes only, and should not be construed as investment advice. Nothing produced here should be considered a recommendation to buy or sell any particular security.